Great Prairie Group follows the performance of the U.S. economy and select industries that we serve. We publish a quarterly overview of the economy in the form of a dashboard of indicators, select sectors and related industries, and the implications for business strategy formulation.

THE U.S. ECONOMY: A DASHBOARD

On display, a dashboard of select economic indicators appropriate for business managers helps to take a meaningful snapshot of the economy. Through monitoring, business managers can survey the economic outlook, existing economic conditions on the ground, and the underlying shifts in the business cycle.

Any single indicator taken in isolation provides little value. Together at the dashboard level, the indicators, data, and supporting charts offer a current high-level view and an easy comparison to draw your conclusions about the economic outlook and underlying shifts in the business cycle.

EXHIBIT 1. A DASHBOARD OF THE U.S. ECONOMY

Lagging Indicators

Change

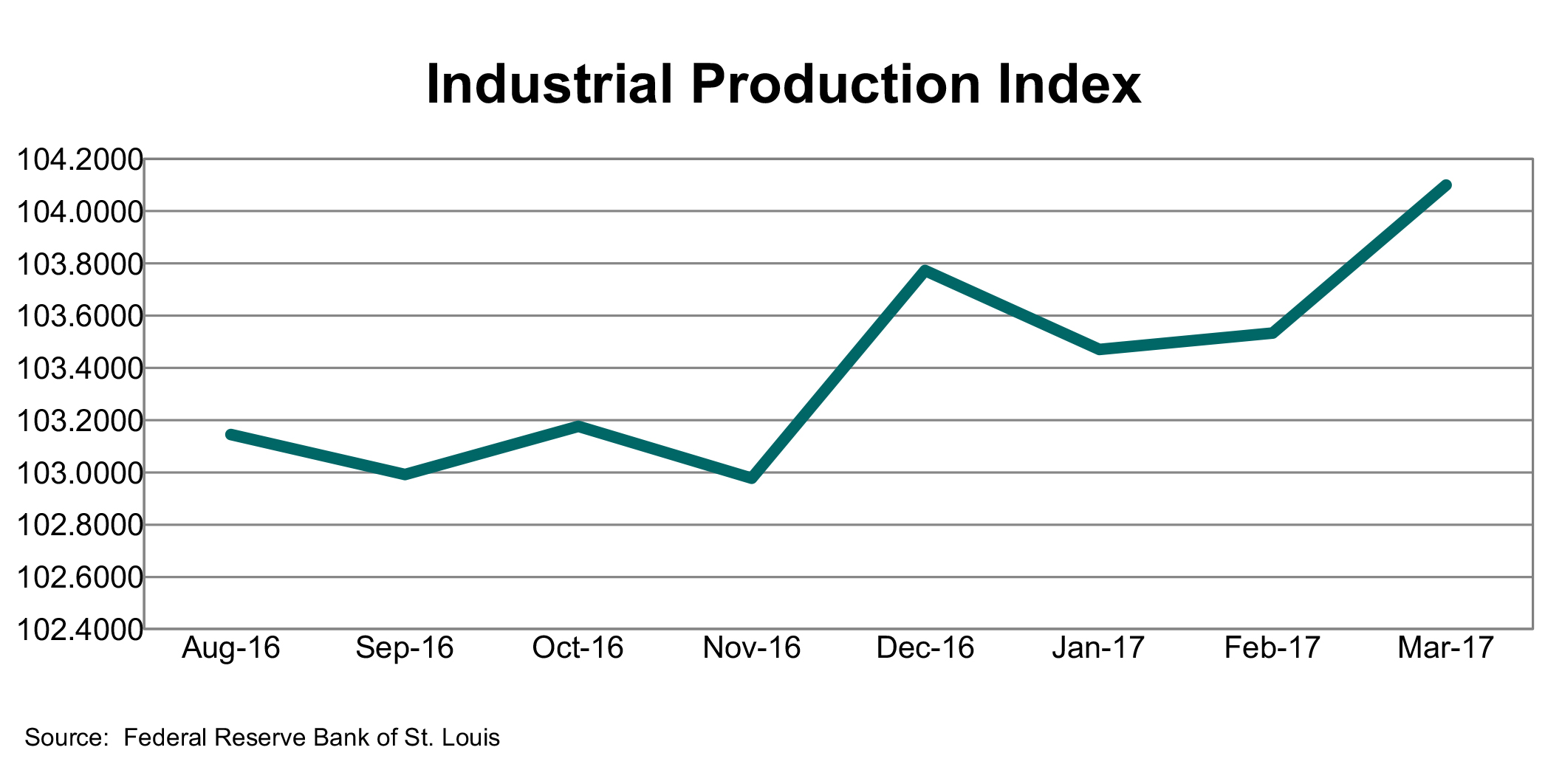

This index measures the amount of output from the manufacturing, mining, electric, and gas industries. The reference year for the index is 2002 and a level of 100. A measure growing month-over-month is a sign that the companies in the industry are performing well.

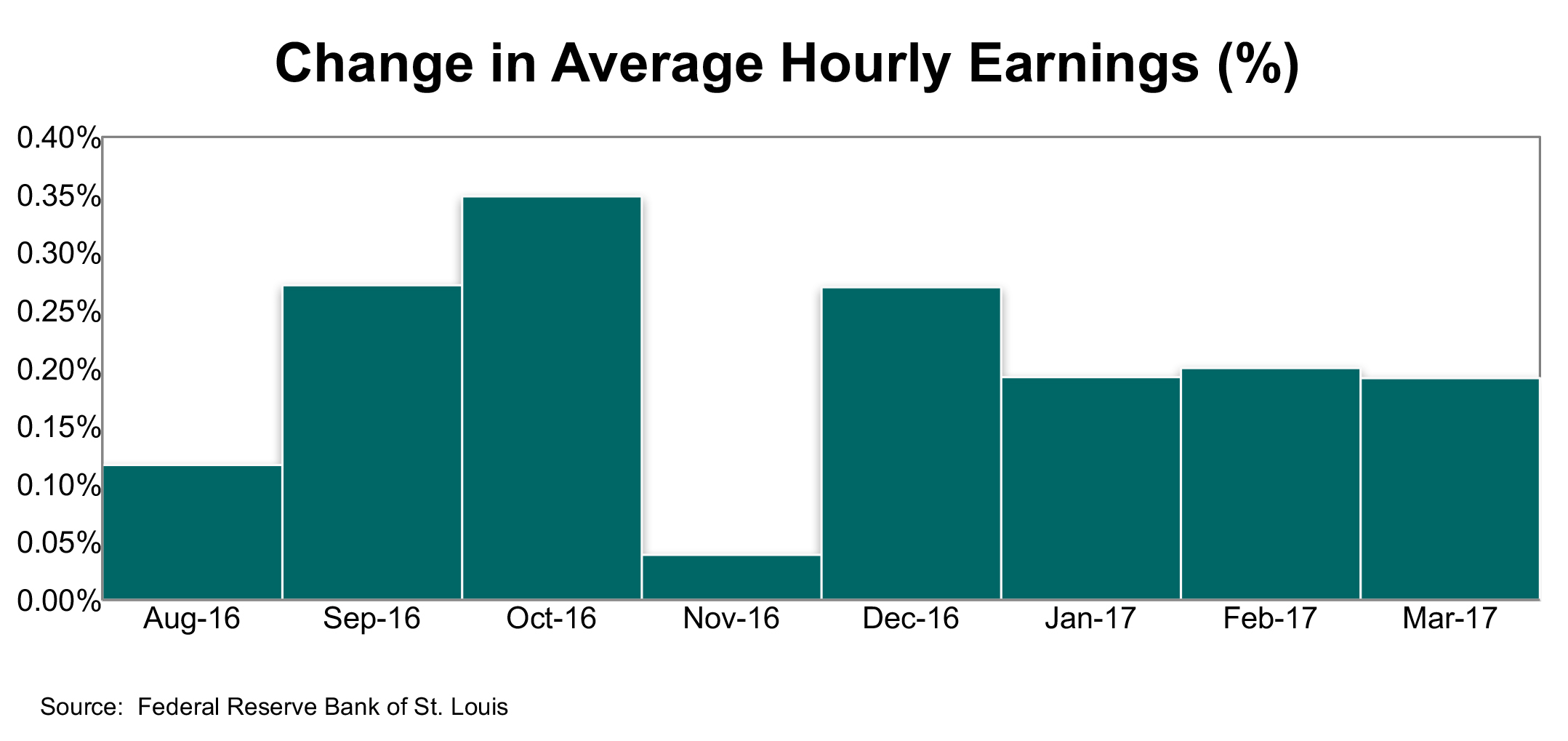

Source: InvestopediaThis is an indicator of buying power and consumption. A positive change means workers are getting paid more. If not eroded by inflation, an increase in earnings means more money to spend. Conversely, a negative change means workers are getting paid less, reducing buying power and consumption.

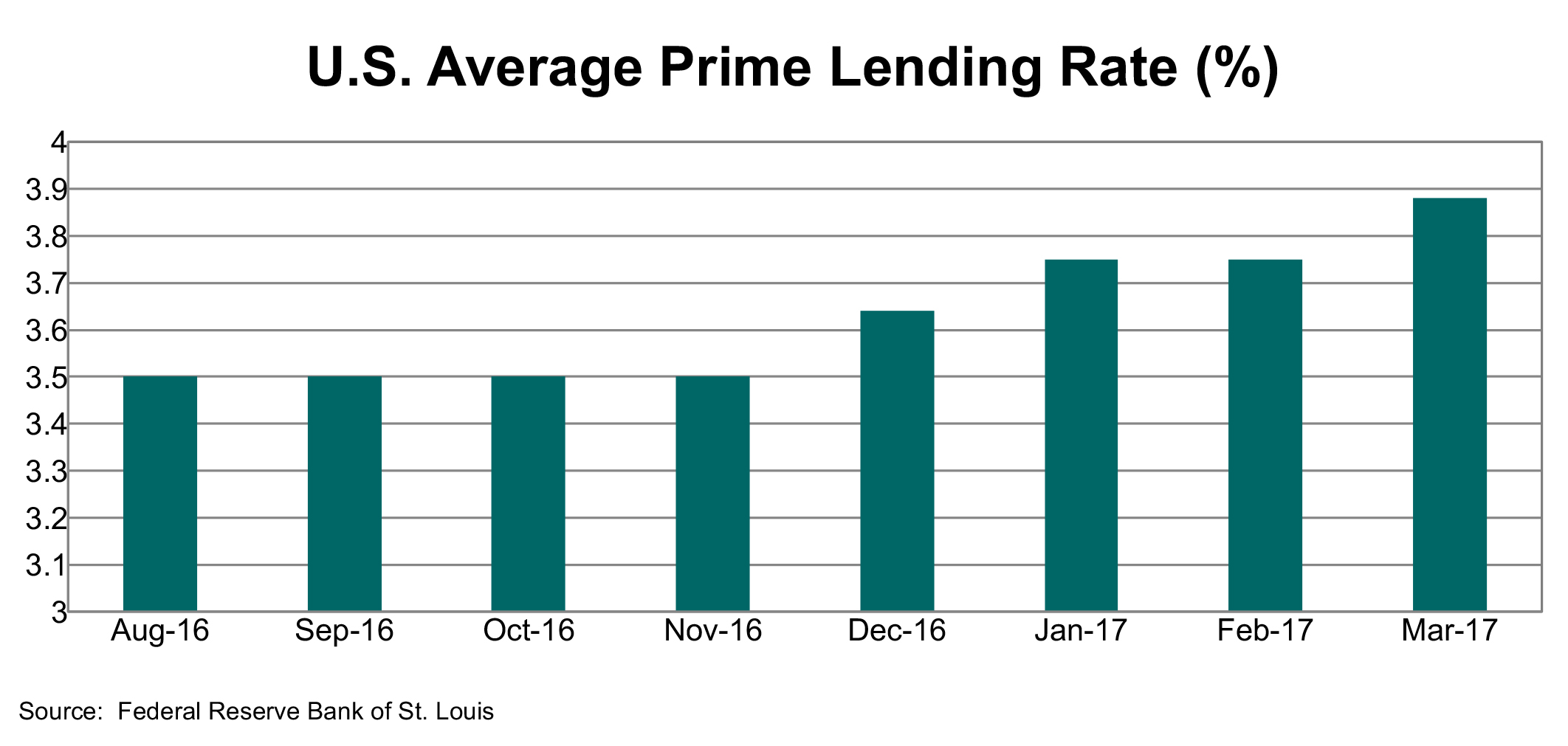

This measure is the average rate of interest charged on short-term loans by commercial banks to companies. High interest rates discourage businesses to borrow and invest. As a result, GDP growth slows down. Low rates can lead to an increased demand for money and raise the likelihood of inflation.

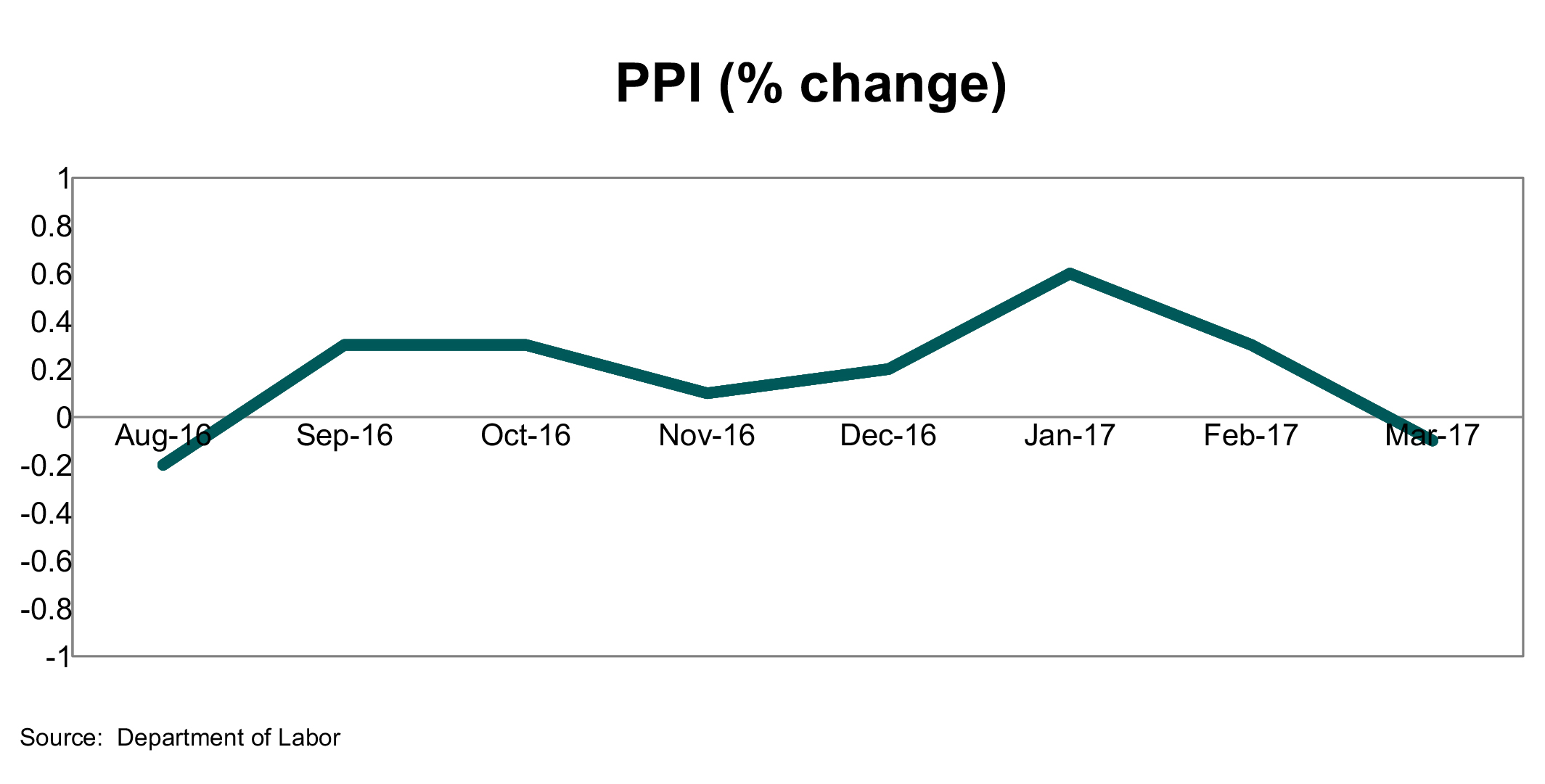

Source: WT Wealth ManagementThis index measures the average change over time in the selling prices received by domestic producers for their output, including finished goods, intermediate goods and crude goods. The index is timely because it is the first inflation measure available in the month.

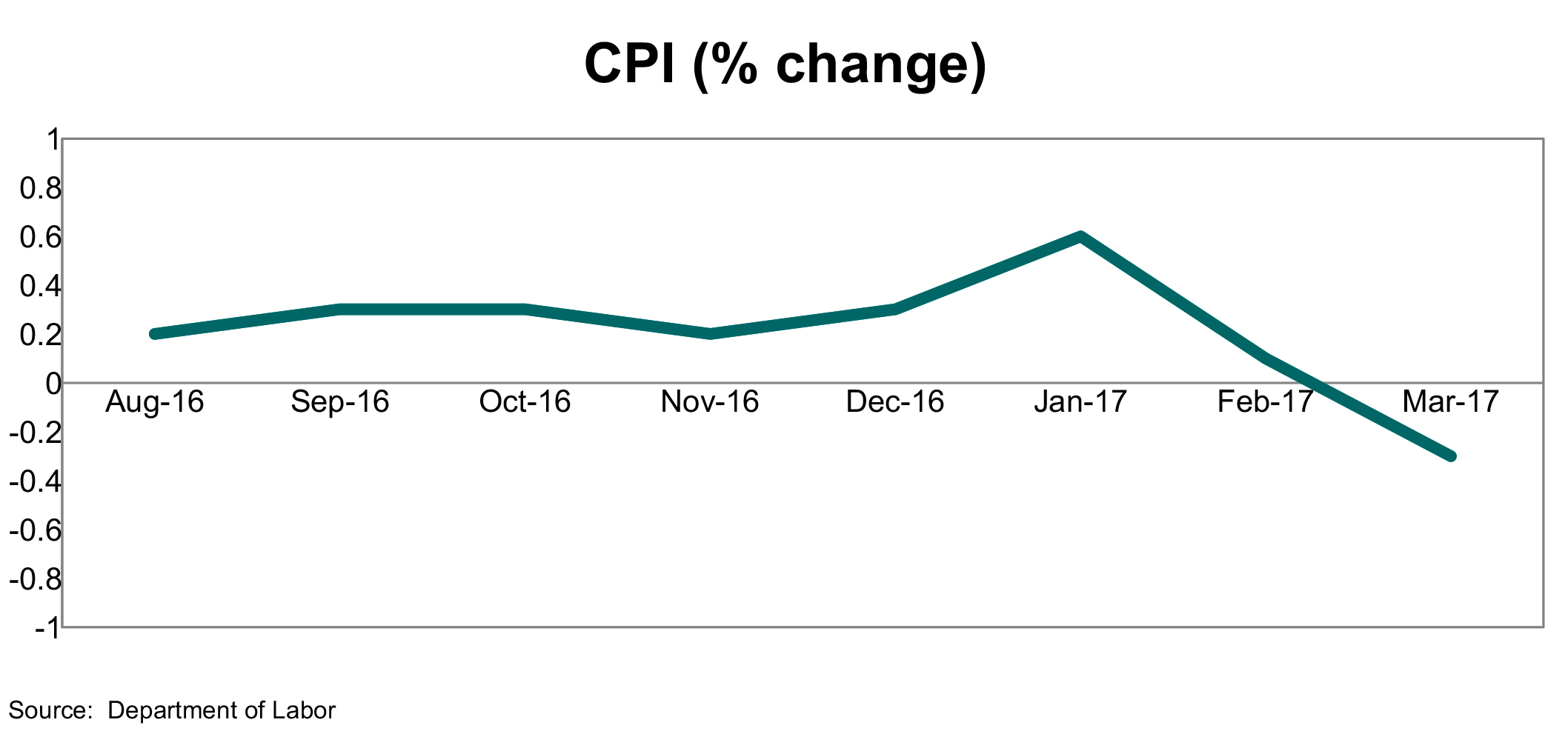

Source: American Association of Individual InvestorsThis index reflects monthly data on changes in the cost of living, or inflation. A high rate of inflation may erode the value of the dollar more quickly than the average consumer’s income can compensate, thus decrease consumer purchasing power. The index is the best indicator of inflation.

Lagging indicators depict current economic conditions and confirm turning points in the economy.

Leading Indicators

Change

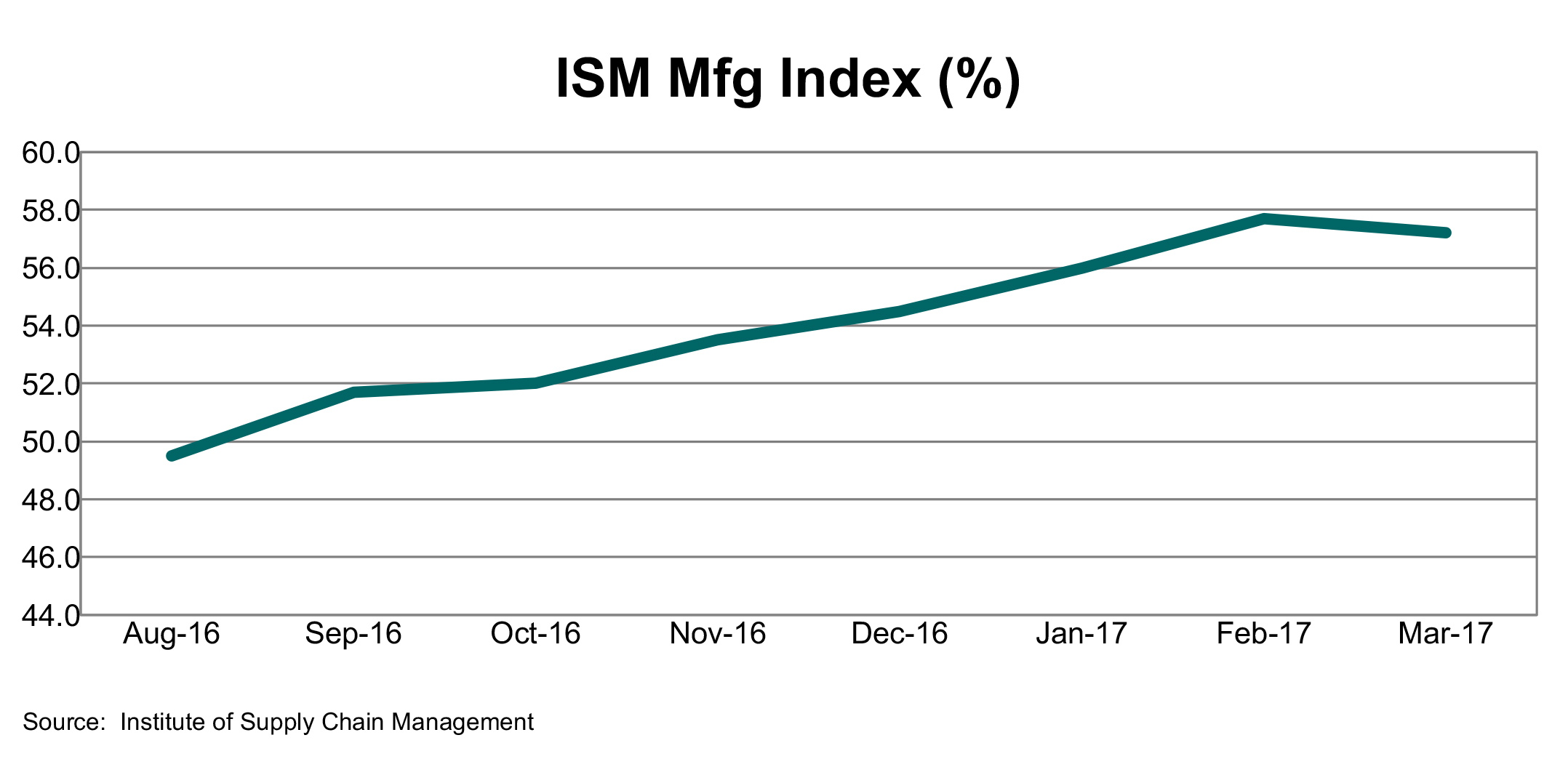

Historically, readings of 50 percent or above are associated with an expanding manufacturing sector and healthy GDP growth overall. Readings below 50 indicate a contracting manufacturing sector but overall GDP growth is still positive until the ISM index falls below 42.5 (based on statistics through January 2011).

Source: Bloomberg News

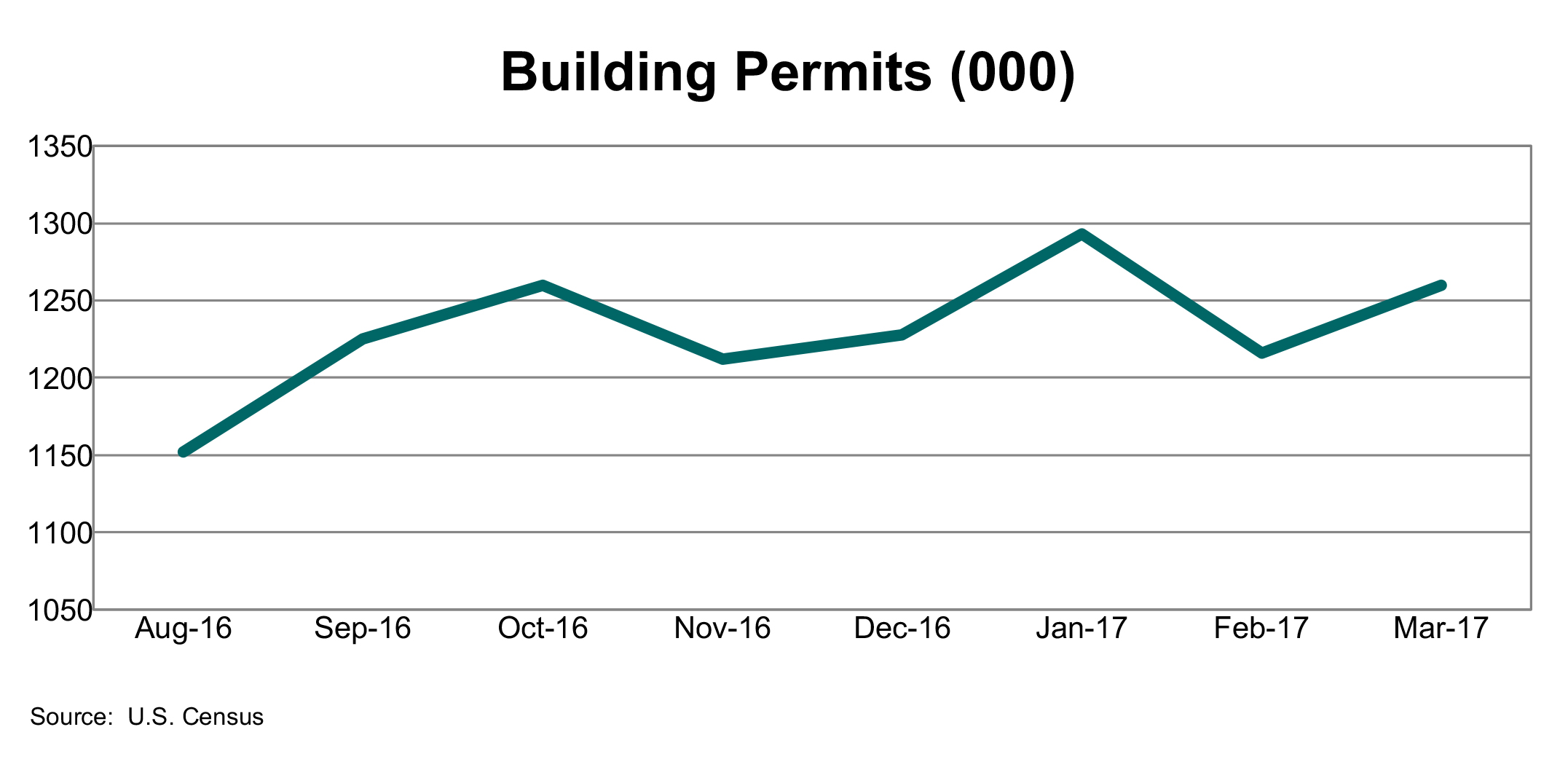

The housing construction market is one of the first economic sectors to rise or fall when economic conditions improve or degrade, and building permits can be an early indicator of activity in the housing construction market.

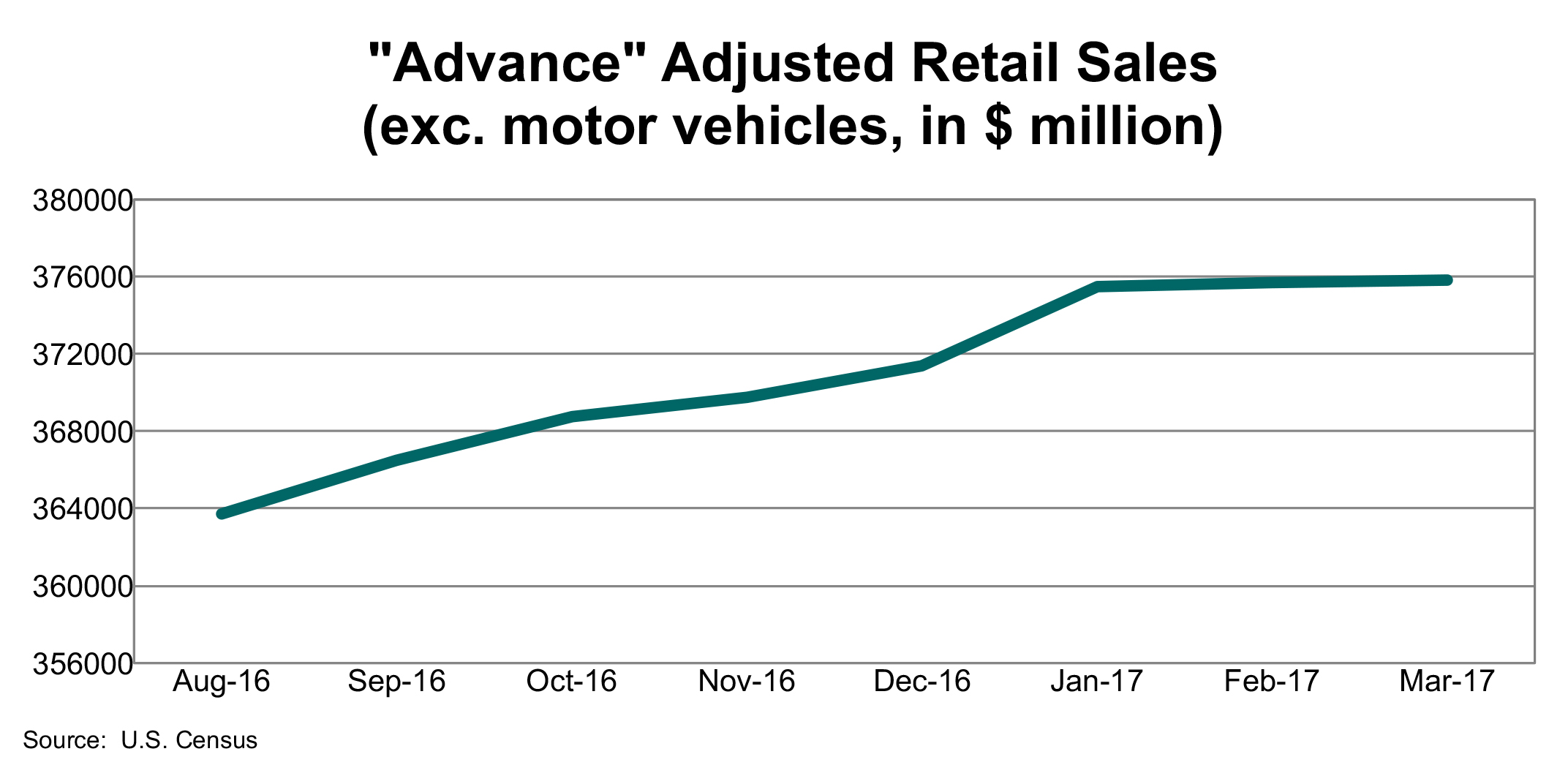

Strong retail sales directly increase GDP. When sales improve, companies can hire more employees to sell and manufacture more product, which in turn puts more money back in the pockets of consumers. Weak retail sales have the opposite effect.

Source: WT Wealth Management

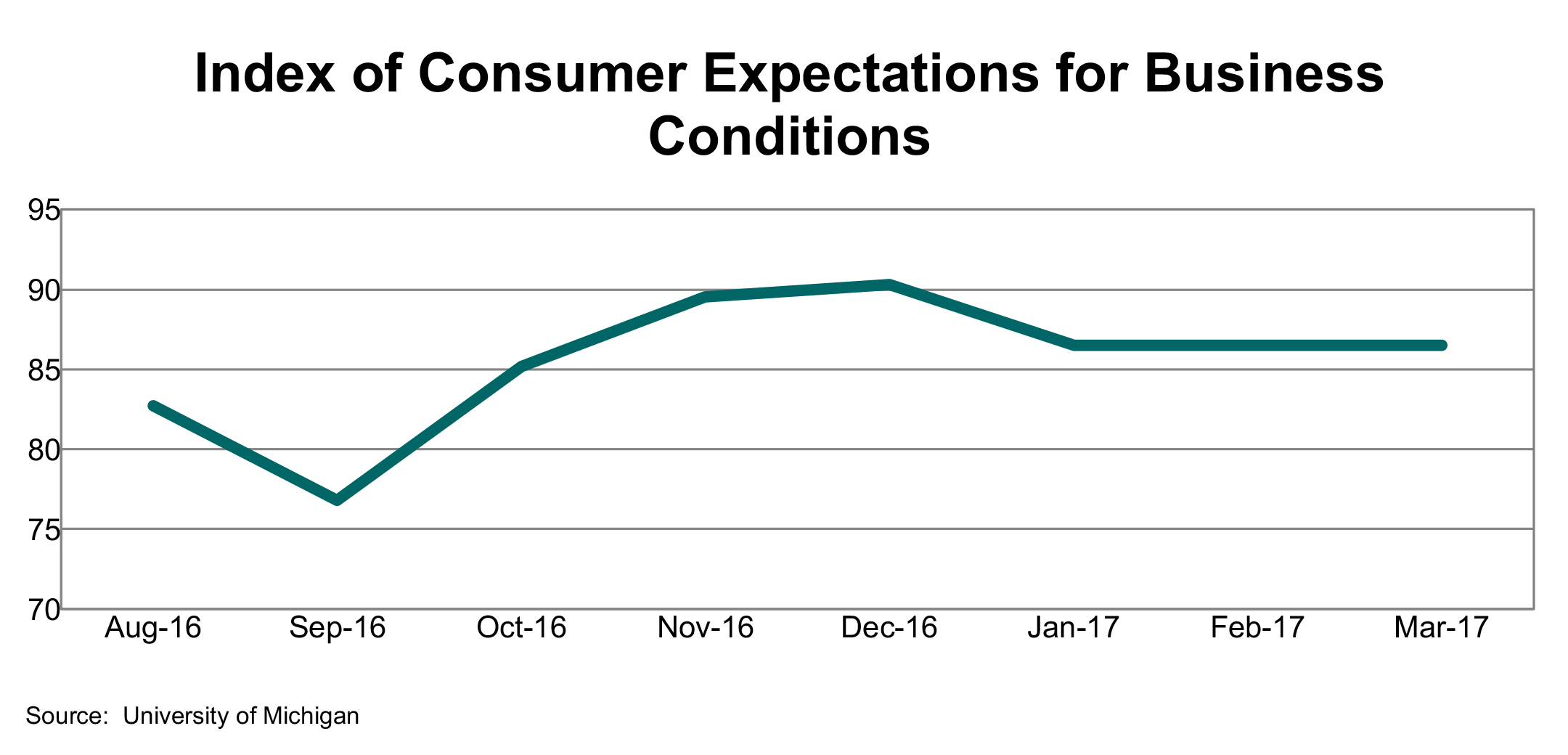

The index measures overall consumer sentiments about business toward the short-term (12-month) future economic situation.

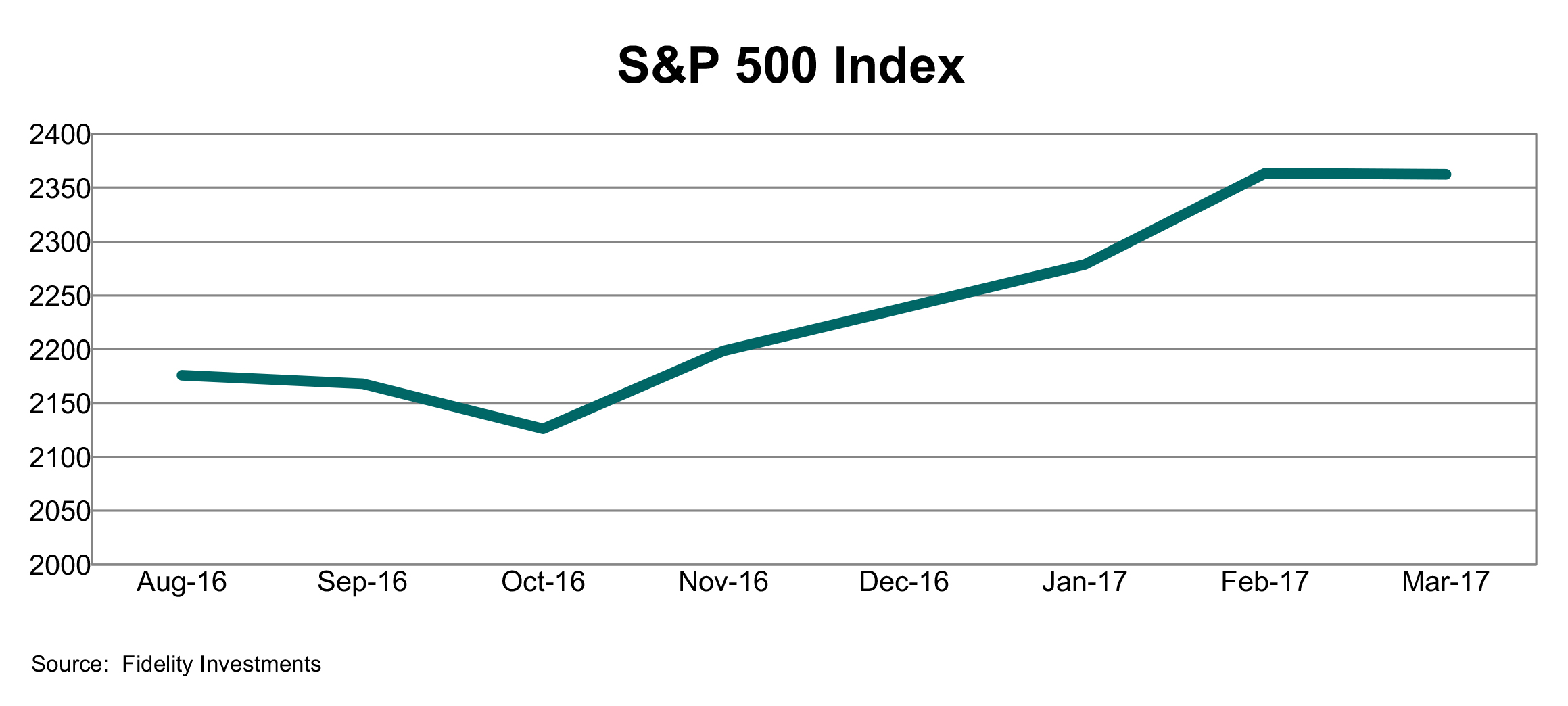

The index is used as a gauge of future business and consumer confidence levels. Growth of the S&P 500 index can translate into growth of business investment. It can also be a clue to higher future consumer spending. A declining index can signal a tightening of belts for both businesses and consumers.

Source: American Association of Individual Investors

Leading indicators are first to change direction ahead of a business cycle and signal change before actual changes occur in the economy.

On display, a dashboard of select economic indicators appropriate for business managers helps to take a meaningful snapshot of the economy. Any single indicator taken in isolation provides little value. Together at the dashboard level, the indicators and their supporting charts offer a current high-level view and an easy comparison to draw your conclusions about the economic outlook, changes in the economic cycle, or other critical economic shifts.

How will the current economic outlook

impact your business?

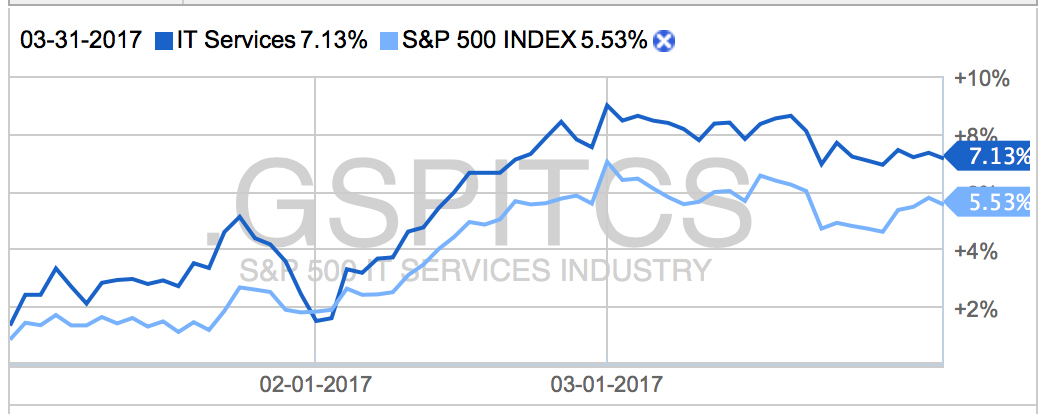

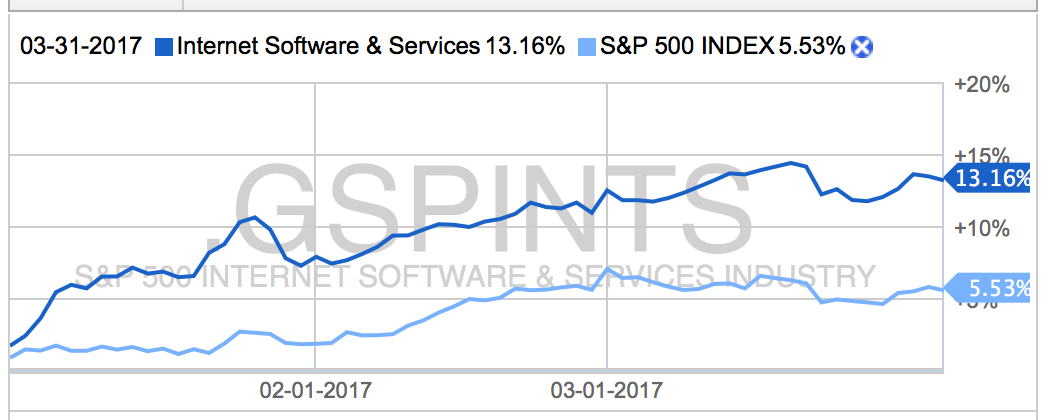

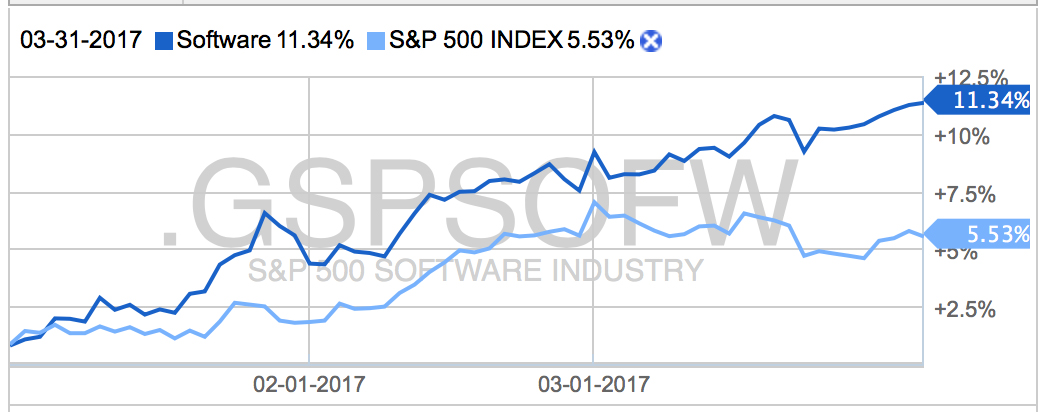

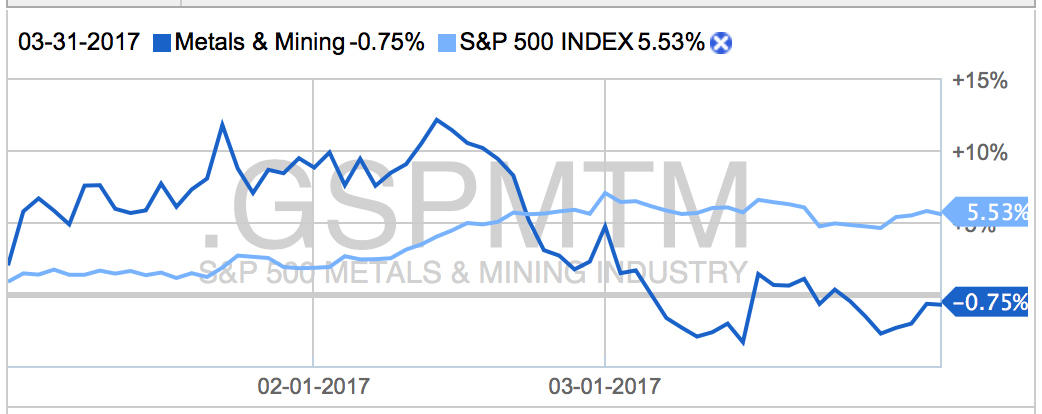

INDUSTRY PERFORMANCE

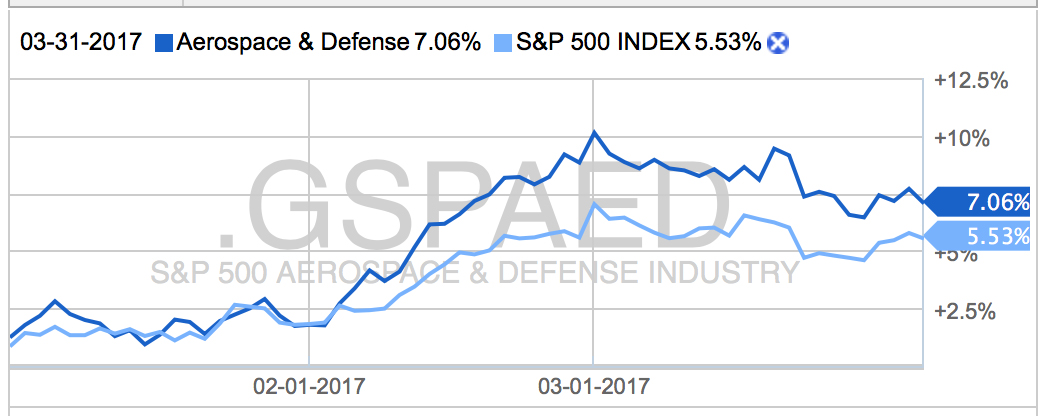

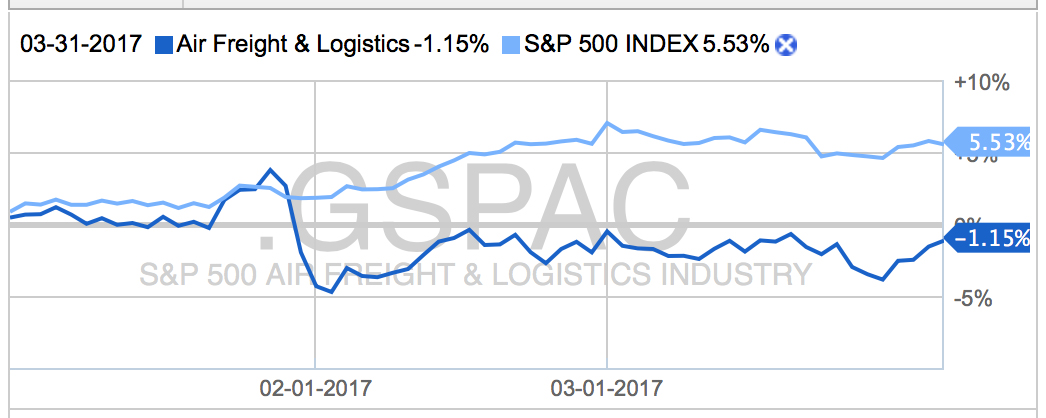

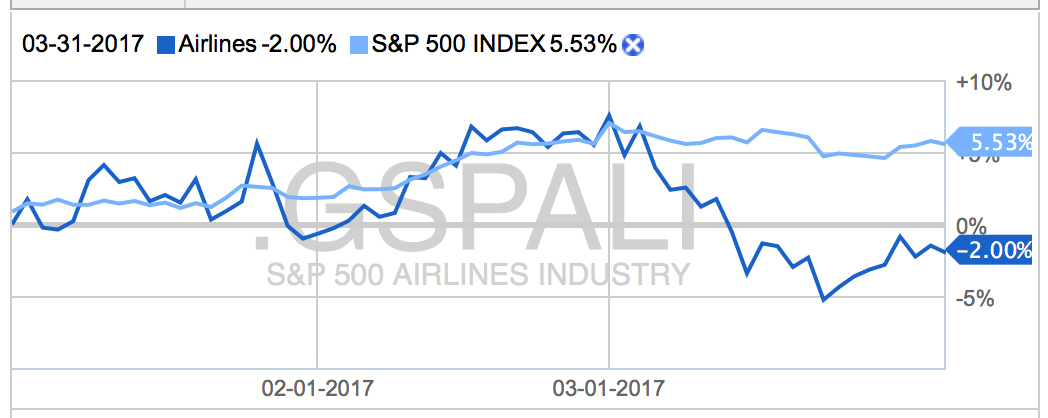

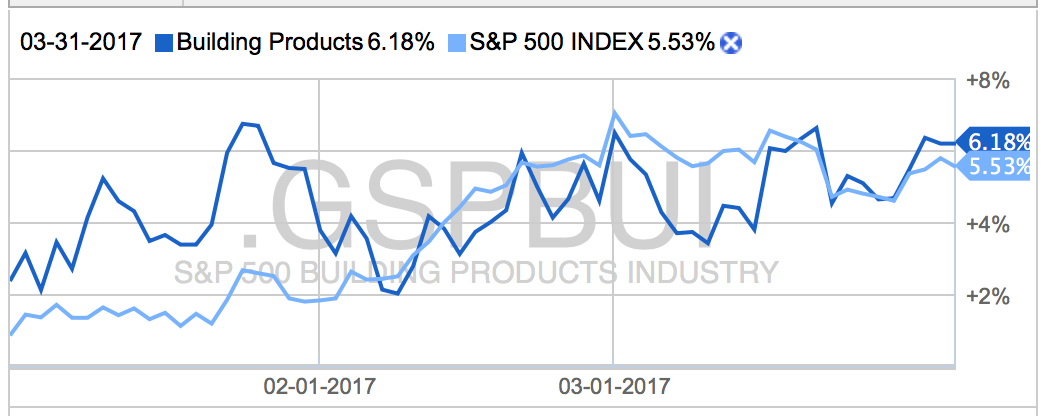

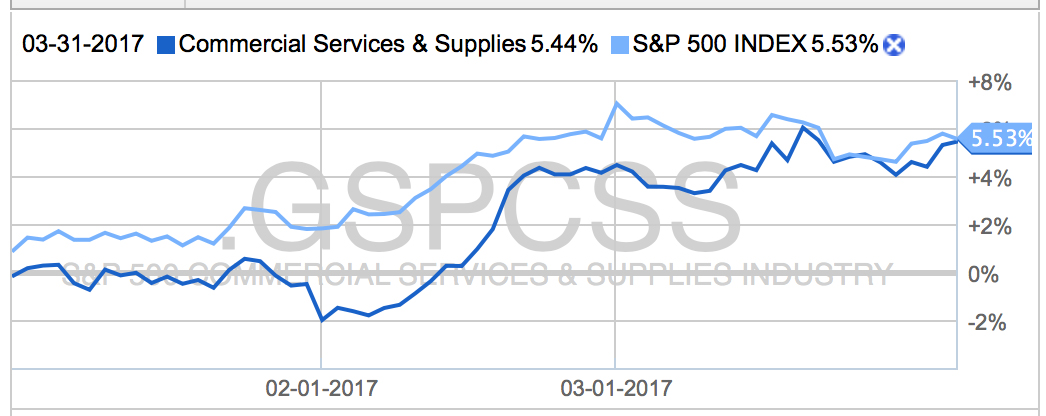

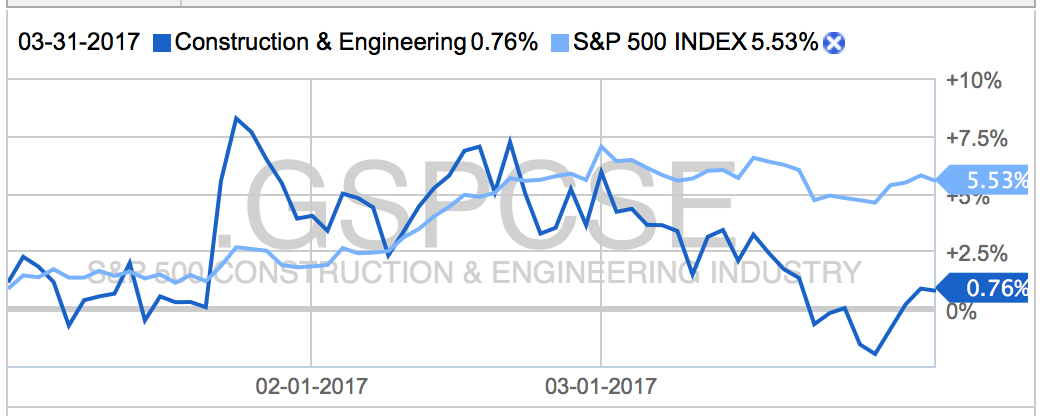

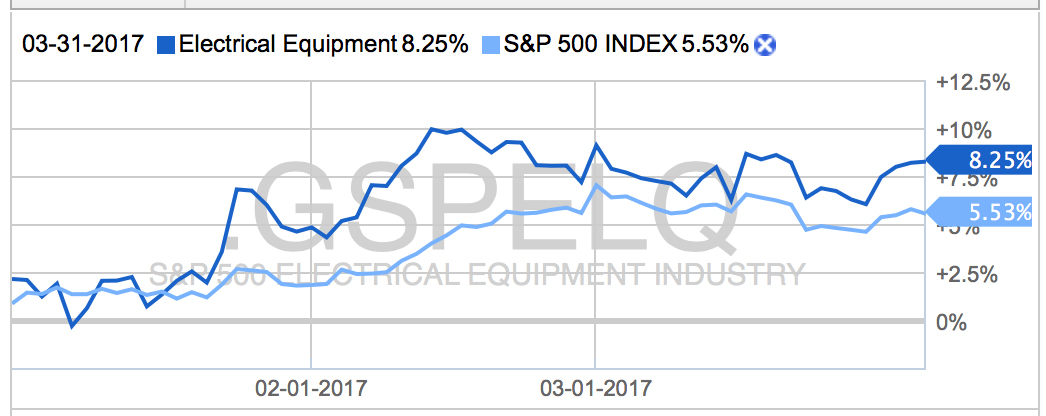

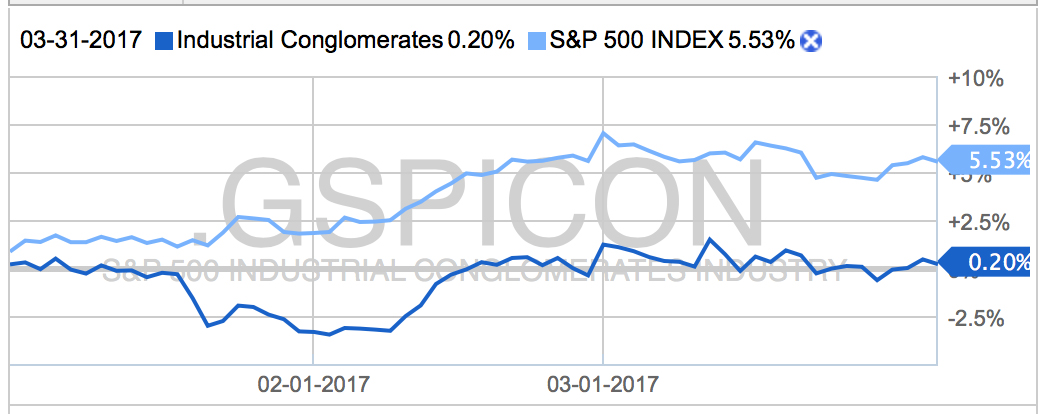

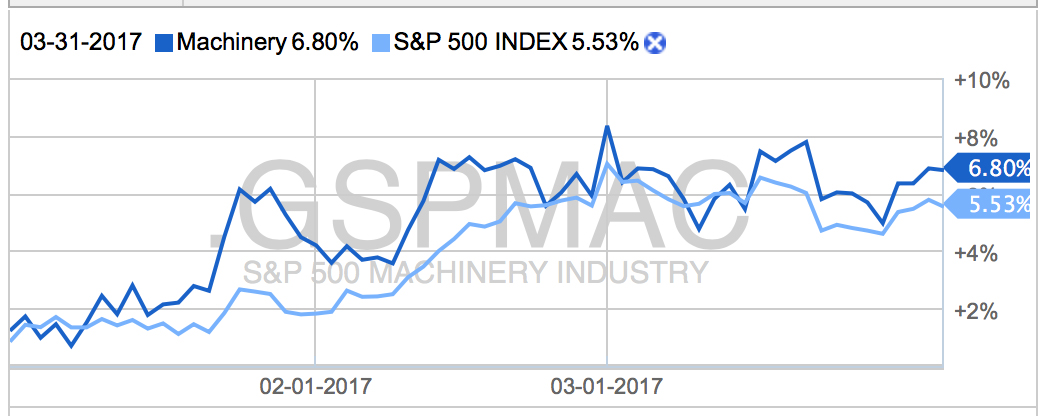

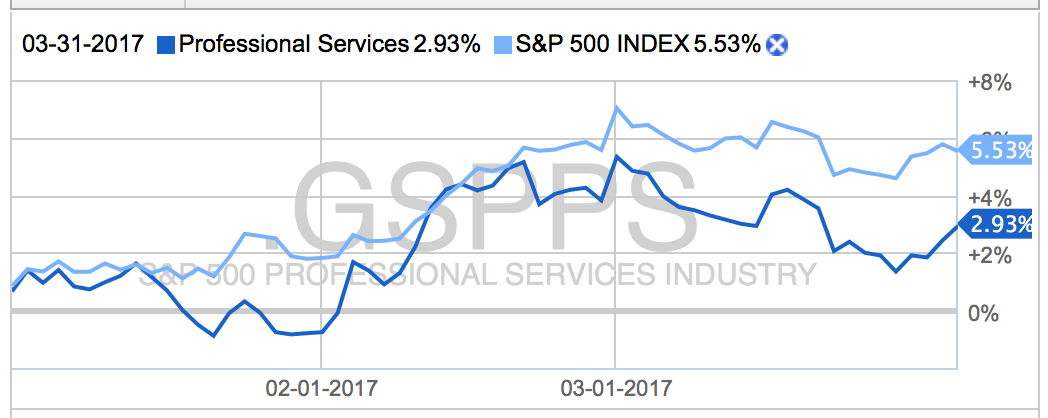

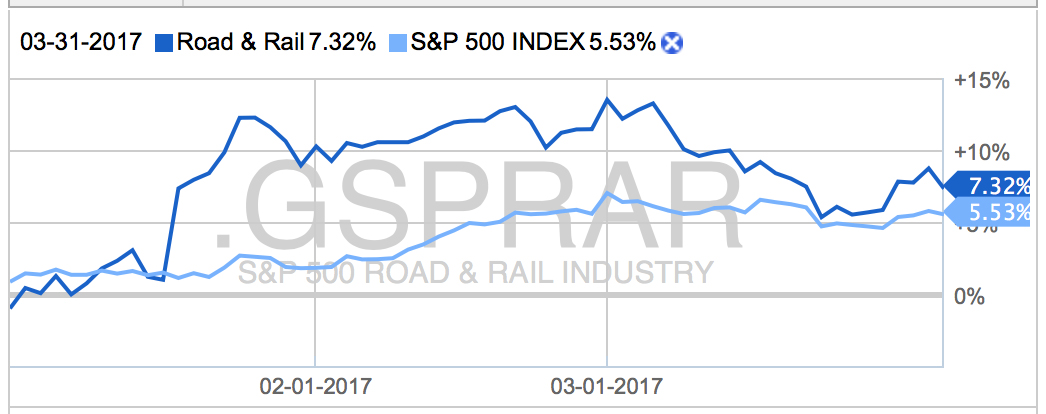

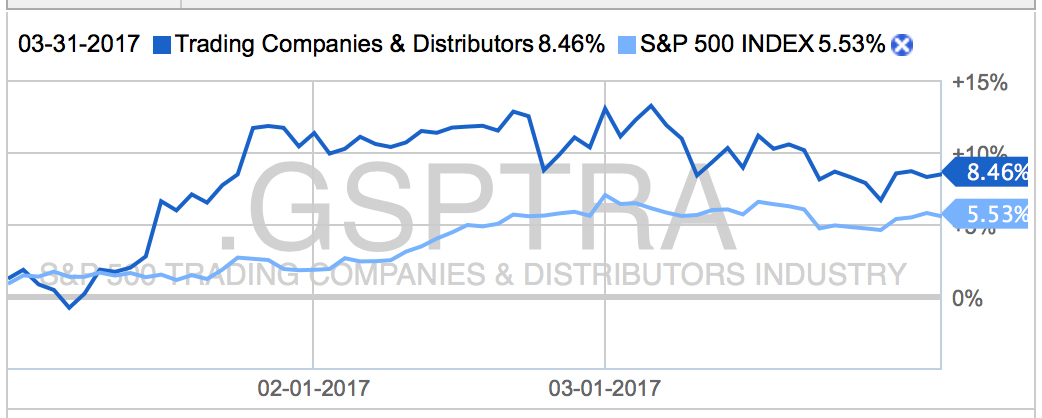

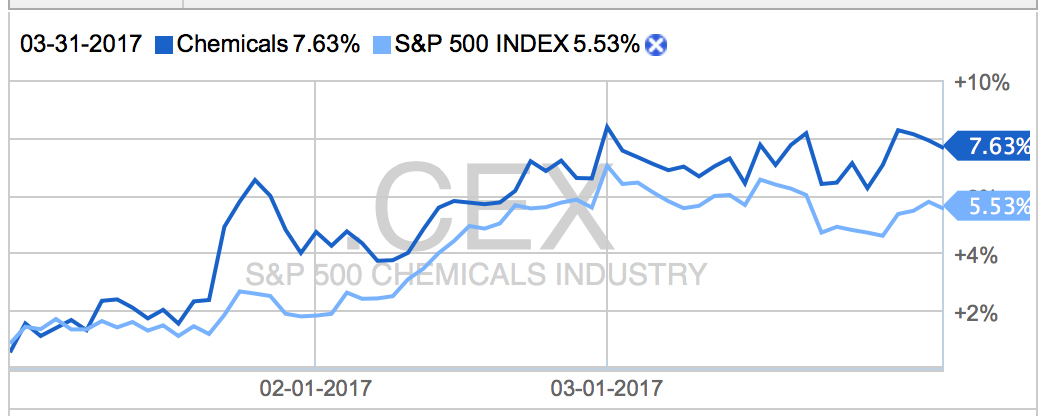

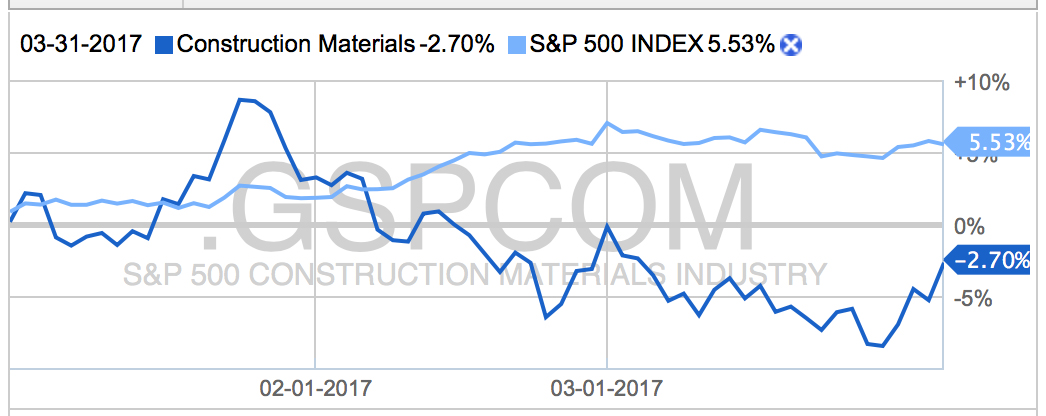

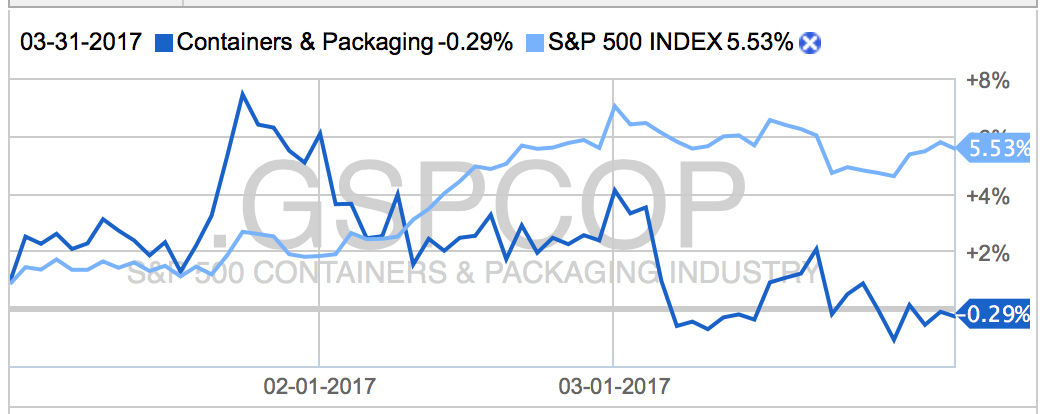

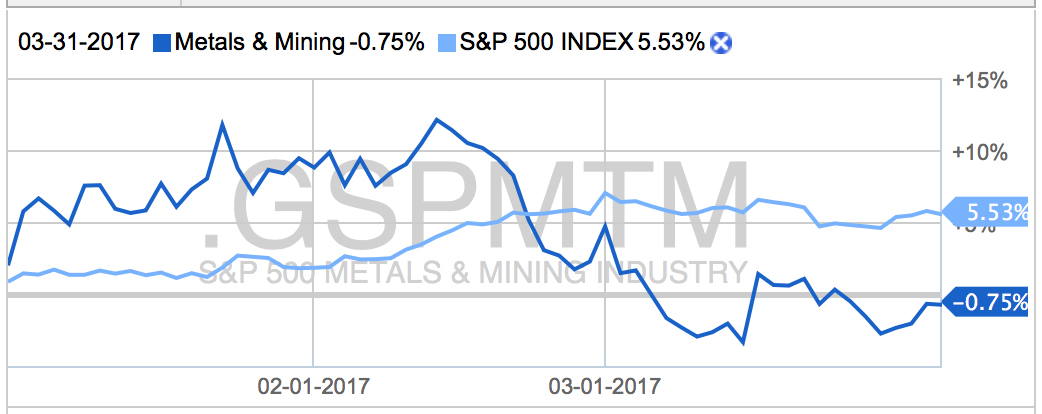

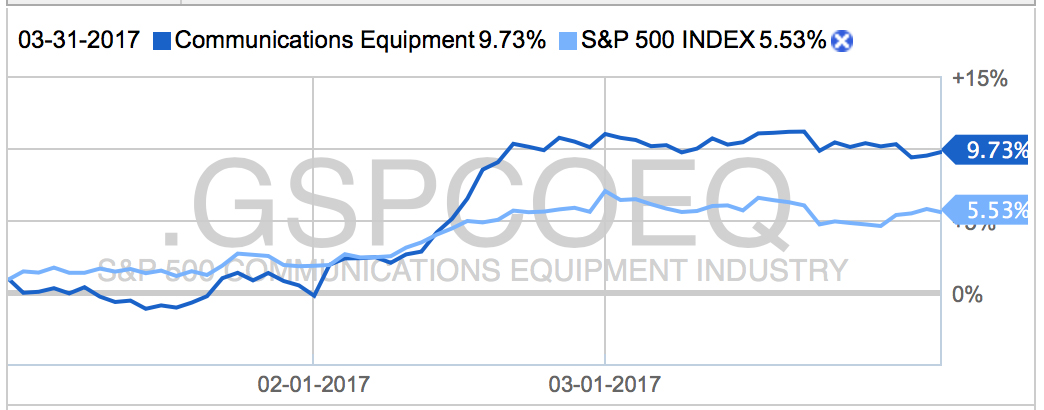

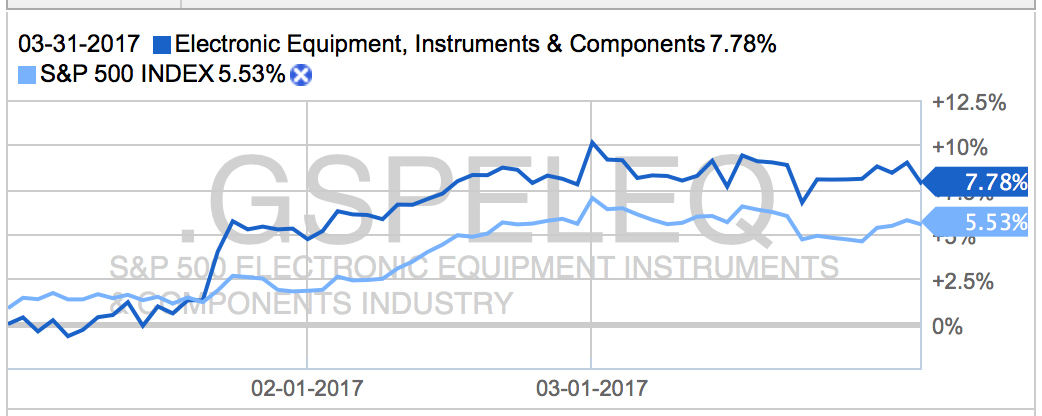

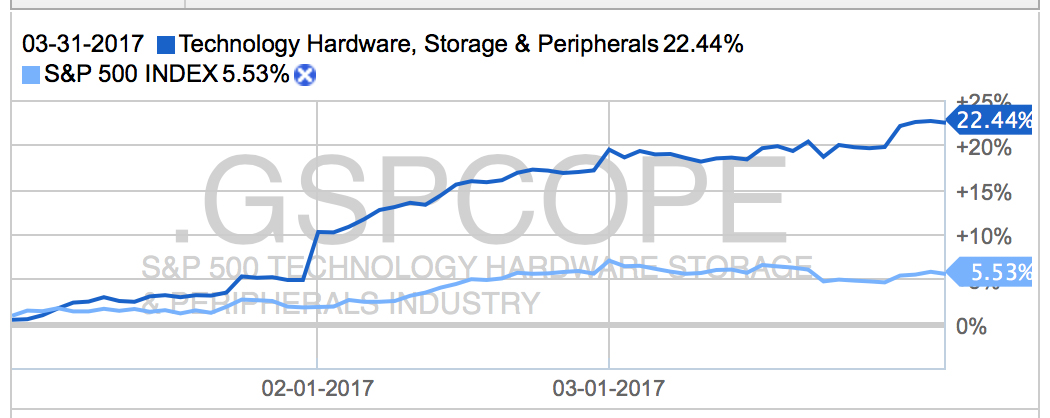

We follow sectors and industry performance relative to the U.S. S&P 500 Index. By tracking their specific industry, business managers can keep on eye on industry performance and prevailing trends.

Each industry index aggregates adjusted market-value-weighted capitalization of a representative group of publicly-traded companies that are prominent players in the market. Each index resets at 0% for the quarter.

We cover three sectors:

- Industrials

- Materials

- Information Technology

EXHIBIT 2. QUARTERLY MARKET PERFORMANCE FOR INDUSTRIES IN THE INDUSTRIALS SECTOR

EXHIBIT 3. QUARTERLY MARKET PERFORMANCE FOR INDUSTRIES IN THE MATERIALS SECTOR

EXHIBIT 4. QUARTERLY MARKET PERFORMANCE FOR INDUSTRIES WITHIN THE INFORMATION TECHNOLOGY SECTOR

Is your industry over/under-performing the

S&P 500 Index?

IMPLICATIONS FOR YOUR COMPANY

Effective strategic moves may be available for your company to beat the market and gain a leading position. These moves are contingent on three factors:

- The impact of the current economic outlook (expansionary, contracting, peak, or through) on your business

- The performance of your industry relative to the market (over/under-performing), and

- Your company’s competitive position

A preliminary view of a company’s competitive position includes its strategic and financial performance.

What is your company’s competitive

position?

Leveraging this knowledge will put your business ahead of trends and ahead of competitors, two important tests of a powerful business strategy. Leading companies, fast-growth start-ups, and winning private-equity firms become market leaders and stay ahead of the game by incorporating these factors into their business strategy. Those who don’t inevitably get left behind.

Would you like to know more about

what we do for our clients?

For a confidential test of your company’s competitive position and best-practice business strategy formulation, contact us for a free consultation.