Reducing lines of business and improving

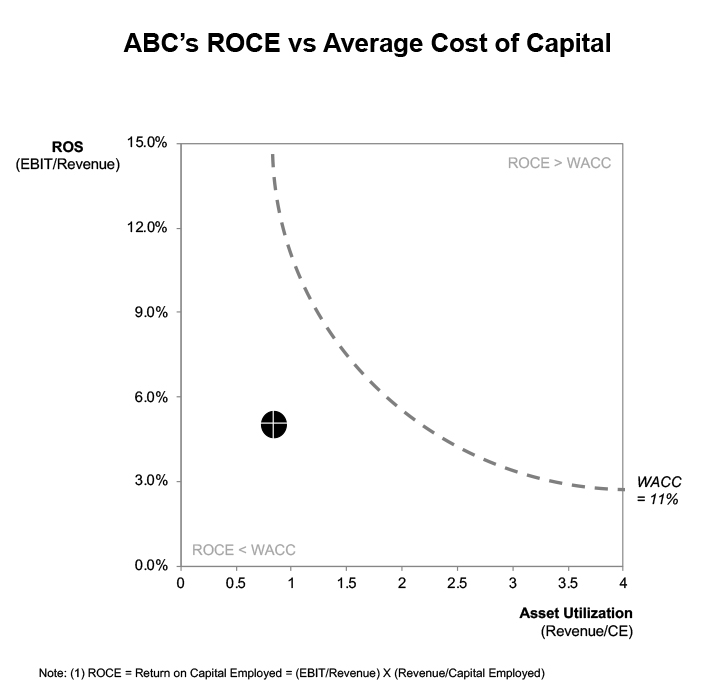

Satellite Co. was a leading manufacturer of satellites, including commercial satellites with revenue of $670 million. The satellite industry was global and included two large market segments: government and commercial. The satellite market was growing at less than 1%. There was significant production overcapacity in the industry, forcing consolidation. The business was earning $30 million/year and was cash-flow positive at $20 million. However, it was eroding its financial position quickly as it was not earning its cost of capital. The objective was how to remain competitive in a consolidating industry given the company’s large cost structure, its large base of fixed assets, and required continued investments.

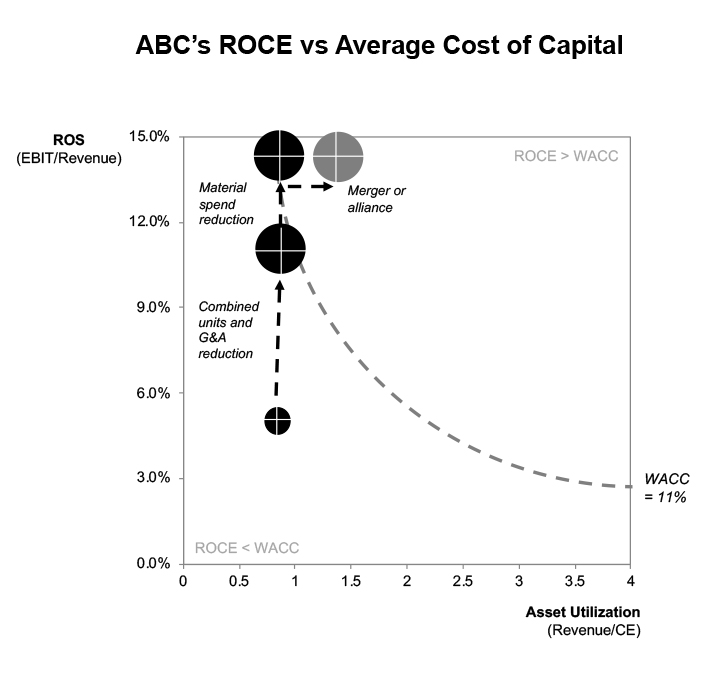

Recommended combining the Commercial Telecom Satellite and Military Telecom Satellite business lines into one to extract value

- Recurring G&A cost savings of $55 million/year

- Recurring Material Management cost savings of $45 million/year

- EBIT improvement from 7.5% to 14.1%

- Improvement in Asset Leverage (Revenue / Capital Employed) from 0.89 x Revenue to 0.92 x Revenue

- Overall ROCE target of 13%, exceeding the cost of capital of 11%

In addition, recommended testing buyers’ interest in a potential sale

- Selling the combined Commercial and Military Telecom satellite business to a competitor

- Reduction of operating assets by $250 million

- Synergies included asset consolidation, improving Asset Leverage from .92 x Revenue to 1.13 x Revenue

- This result would increase ROCE to 15.9%

- However, the deal would be expensive as acquisition Aerospace & Defense multiples had risen from 0.3 x Revenue to 1.5 x Revenue as industry consolidation was approaching an end-point.

We analyzed the industry, its financial determinants, and various scenarios for the company to earn its cost of capital.

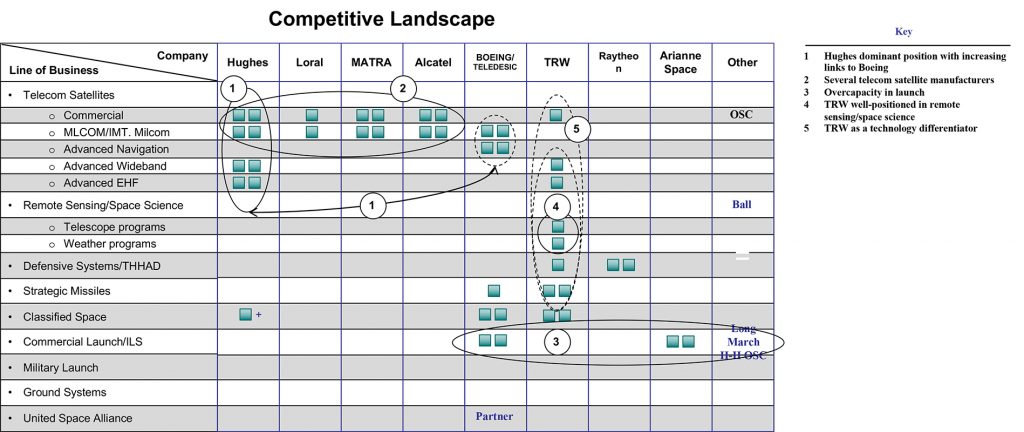

INDUSTRY AND MARKET ANALYSIS

Estimated overall industry structure and level of consolidation

Estimated market size, historical growth, and breakdown by segment

Estimated segment share by competitor

Assessed the competitive landscape, including key issues by competitor

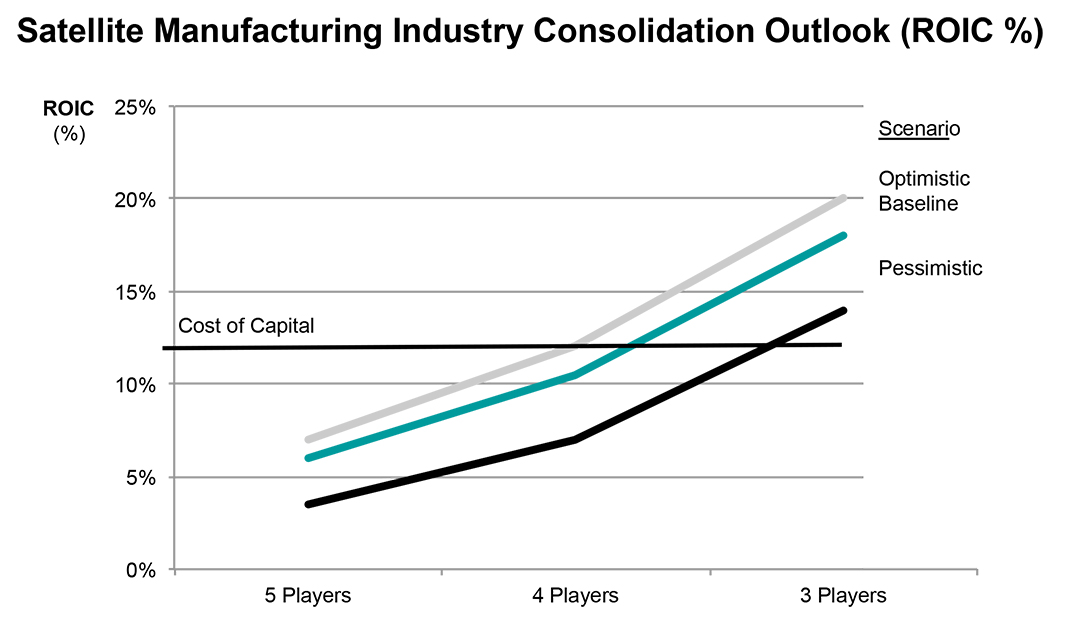

SCENARIO ANALYSIS

Determined the industry cost of capital and overall Return on Invested Capital (ROIC)

Analyzed various industry scenarios based on the number of players (5, 4, and 3)

Determined that a 3-player industry scenario would be the only feasible option for companies to earn their cost of capital

FINANCIAL ANALYSIS

Analyzed company profitability, cash flow, and growth by business line, including

- Civil and Military Space

- Commercial Telecom

- Military Telecom

Identified Commercial Telecom as particularly weak and Military Telecom having limited growth opportunities

COMPARATIVE VALUATION OF BUSINESS LINE CONSOLIDATION

Determined feasibility of combining Commercial Telecom unit with Military Telecom unit, including

- combined capabilities

- combined benefits, including

– rationalization of production facilities

– cost savings (one time, recurring)

– rationalization of investments - overall financial position

COMPARATIVE VALUATION OF POTENTIAL M&A DEALS

Developed detailed profiles by competitors, including

- Financial performance

- Product lines

- Customer sales

- Existing relationships with satellite operators

- Services

- Distinctive skills

Determined feasibility of alternative deals based on the following metrics

- market share

- combined capabilities

- combined contributions

- combined benefits, including

– rationalization of production facilities

– cost savings (one time, recurring)

– rationalization of investments

For each M&A deal, determined financial implications for the company, including the total amount of shareholder value creation

FINAL DETERMINATION

Determined best opportunity based on two factors

- strategic end game

- financial value