Strategic control points are the critical foundations for the business to safeguard and enhance value. The concept was first introduced in the late 1990’s.(1) Strategic control points (SCPs) provide the infrastructure for building market power by insulating the company’s profit streams against erosion from competitors, customer power, and supplier power. The importance of SCPs also cuts the other way: without strong SCPs, businesses eventually lose ground and, in extreme cases, get swept away.

SCPs come in many forms. Examples include having a dominant market position in attractive segments, locking up distribution channels, controlling the value chain, owning a de facto business standard, and many more.

Exhibit 1. Strategic Control Point Examples

Strategic control points are industry-specific, and some are more relevant than others. In mobile telephony, for example, innovation lead time is crucial. In the container shipping industry, large shipping capacity is essential. In retail, advanced inventory management technology is vital. In the software industry, owning the de facto technology standard is the name of the game. And so forth. The best firms secure two or more relevant SCPs in their industry.

Strategic control points are important for three reasons

1. The more successful your business, the more likely competitors will try to take a piece of the action.

BlackBerry provides a prime example of an incumbent who lacked the relevant SCPs and was disrupted by new entrants.

CASE: Blackberry

BlackBerry provides an excellent example of an incumbent disrupted by new entrants.

In 2009, Blackberry was a leading vendor of smartphones, with 20% share of the global market. As a pioneer in the industry, it owned a large customer base with strong brand loyalty. What made its smartphone attractive at the time was compatibility with any carrier in the world, best security, regular e-mail, its physical keyboard, and removable and upgradeable batteries.

Unfortunately, Blackberry wasn’t able to defend its market position. When the Apple iPhone and Google’s Android entered the market, the smartphone industry was moving to touchscreen displays. Apple, Samsung, and HTC jumped on this evolution and exploited it fully. Blackberry didn’t. It delayed new technology releases, banking on product superiority. In the meantime, it failed to secure the relevant strategic control points of the smartphone industry, including the following:

- Privileged information about customer preference – Apple began to deliver products that satisfied new customer needs, including multi-touch touch screens, apps, and synchronization with other devices. Blackberry took time to respond and missed the first customer shift.

- Fast product development lead time – the basis of competition in the smartphone industry is continuous innovation. Blackberry’s new product releases were systematically late and unexciting (the Storm, App World, the PlayBook tablet, BB10 software)

- Creating and maintaining a one-year lead over the next competitor – The first two years of new product release are where pricing power is maximum, and the highest profits come in. Blackberry was always operating in catch-up mode against Apple, never recovered, and systematically missed the profit window.

- Lock on the delivery mechanism – Android and IOS owned superior operating systems. In 2011, the Blackberry internet service experienced a four-day service outage worldwide, at which point customers began to defect.

Lacking an effective defensive strategy, the company went into rapid decline.

Exhibit 2. Blackberry’s Historical Market Performance

2. Without strategic control points, company growth becomes constrained by competitors who can inflict considerable harm.

PTC illustrates the case of an industry leader who lost to competitors that secured the relevant SCPs.

CASE: PTC

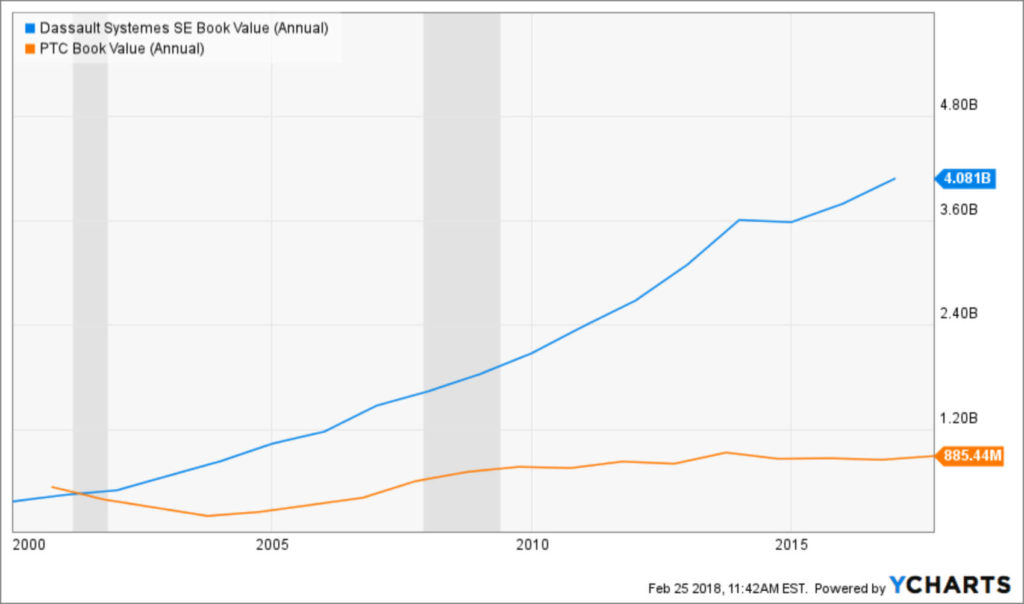

In 2000, PTC, Autodesk, Dassault Systemes, and Unigraphics were the leading CAD/CAM/CAE software providers. Since then, products have evolved from standalone tools to Product Lifecycle Management (PLM) software. This program is an integrated platform to provide a holistic approach to manage the entire lifecycle of a product from its origin, through engineering design and manufacture, to service and disposal of manufactured products.

PTC grew revenue from $928m in 2000 to $1.16 billion in 2017. Its growth was based on its global product brands and heavy marketing but was stunted significantly by Dassault Systemes and Unigraphics (since acquired and rebranded Siemens PLM). So, while PTC was focused on growing product sales across international markets and industry segments, Dassault Systems and Siemens PLM were defining the next-generation PLM software and securing the strategic control points of the PLM software through acquisitions.

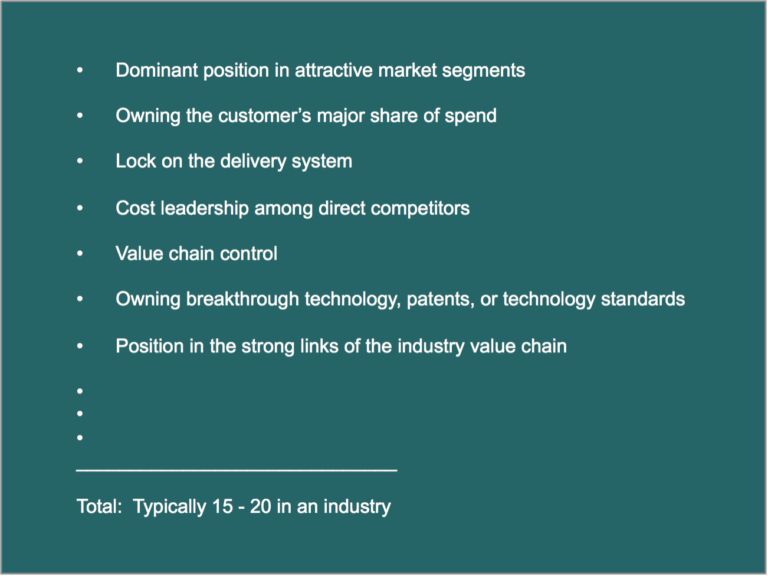

Exhibit 3. Historical Book Value: Dassault Systemes vs. PTC

Like PTC, each firm offers superior global product brands (Dassault Systemes’ CATIA, Solidworks, ENOVIA; Siemens PLM’s PARASOLID, PLM Vis, NX, and Solid Edge). In addition, they have built a vast array of strategic control points, including the following:

- breakthrough PLM technology and key patents

- dominant share in attractive market segments: Aerospace, Automotive, CPG and Retail, Electronics, Engineering & Construction, and Industrial Equipment

- ownership of marquee customer accounts: Lockheed Martin, Boeing, Ford, GM, Exxon Mobil, P&G, and

- largest installed customer base: more than 25 million seats and 400,000 customers between the two of them

As a result of an ineffective defensive strategy, PTC lost its market leadership. In the meantime, Dassault Systemes and Siemens PLM have grown to $3.2 billion and $4.4 billion respectively.

Exhibit 4. Comparative Historical Revenue

3. Strategic control points offer a measure of protection against economic cycles.

The following case illustrates how a firm leveraged an important strategic control point to emerge from an economic recession as a winner.

CASE: Taiwan Semiconductors Manufacturing Company

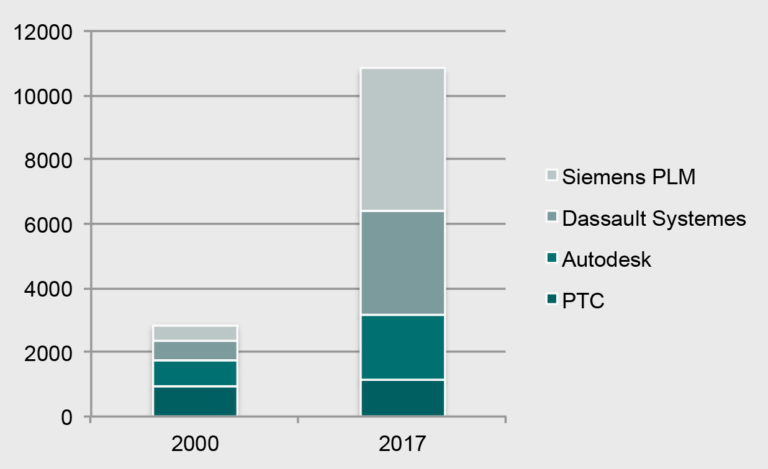

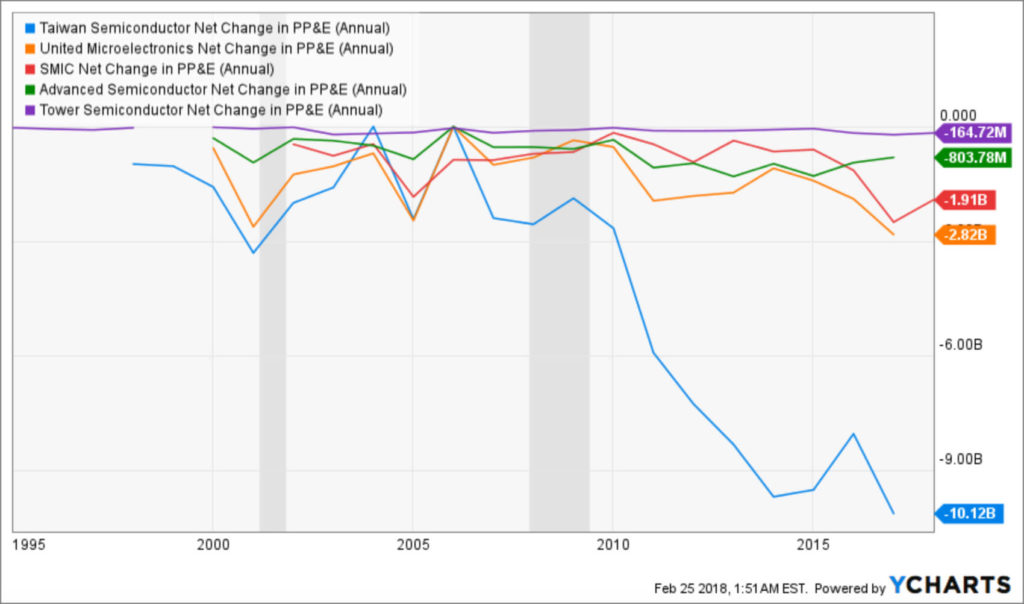

The semiconductor industry experiences large swings in demand during economic cycles. During the 2009 recession, while semiconductor manufacturers reduced cost and managed cash flow to weather the storm, Taiwanese semiconductor manufacturer Taiwan Semiconductor Manufacturing Company (TSMC) took a different approach and invested heavily in manufacturing equipment and facilities. The company owned extensive cash reserves, allowing it to make significant capital expenditures.

Exhibit 5. Comparative Net Change in PPE

The strategy was to exit the recession ahead of the competition in a strong position to deliver products as demand would rise. The plan paid off. TSMC was able to outperform its competitors and has since become the world’s largest dedicated independent semiconductor foundry. In 2017, its market capitalization surpassed Intel for the first time at $226 billion vs. $216 billion.

TSMC’s success is due in part to a robust defensive strategy based on owning several strategic control points in the semiconductor manufacturing industry. They include the following:

- extensive cash reserves to make significant capital investments

- superior R&D

- cutting-edge process technology

- dominant share in attractive market segments (fabless semiconductor companies, integrated device manufacturers, and programmable logic device companies), and

- ownership of large customer accounts (e.g., Apple, NVIDIA, Texas Instruments, Intel, AMD).

Exhibit 6. Comparative Stock Performance of Semiconductor Companies

TSM = Taiwan Semiconductor Manufacturing

SMI = Semiconductor Manufacturing International

INTC = Intel

ASX = Advanced Semiconductor Engineering

TSEM =Tower Semiconductors

UMC = United Microelectronic Corp.

Source: YCharts, GPG Analysis

Securing strategic control points is an explicit pursuit

Growth strategy and defensive strategy are separate pursuits that require different actions. Growth initiatives aim at expanding a business. Examples include developing new products, moving into new markets, accessing new channels, gaining a greater portion of customer spend, growing in size to reap economies of scale.

Unfortunately, these initiatives don’t offer the protection needed when your business comes under attack. Moving into new markets won’t protect your home market. Finding new customers won’t ensure retention of current ones. Expanding your product line can make you more vulnerable if spread thin on too many fronts. Growing in size can make the organization less agile in responding to the market.

A defensive strategy takes securing the relevant strategic control points.

Making moves that matter

Defensive strategy requires informed planning and execution. Winning companies use the following approach:

- Assess new threats as they emerge in the regular course of business

- With a clear read of the situation and the new threat in focus, formulate the right strategic response

- Anticipate competitive retaliation and plan a strong counter-response

- Secure the correct strategic control point(s)

- Continue scanning the environment for new threats and new forms of competition

Companies should prioritize securing a sound defensive position and strategic control points. They provide a defensible platform to sustain profit growth and launch new strategic initiatives.

Citations

- 1 "The Profit Zone" by Adrian Slywotsky and David Morrison, 1997, Times Books, New York, NY