The problem of identifying potential customers for non-existing products is a significant challenge. Customer segmentation is a powerful tool that serves the purpose of identifying customers for specific products or services and measure market size.

However, when it comes to segmenting customers for new products, most companies struggle with segmentation. They apply traditional methods to fit products or customers into existing groups that by definition don’t apply.

Two questions invariably come up: How do you segment customers for products that don’t exist? Or conversely, how do you segment products for customers who have not yet bought the product? We review two approaches.

TRADITIONAL SEGMENTATION

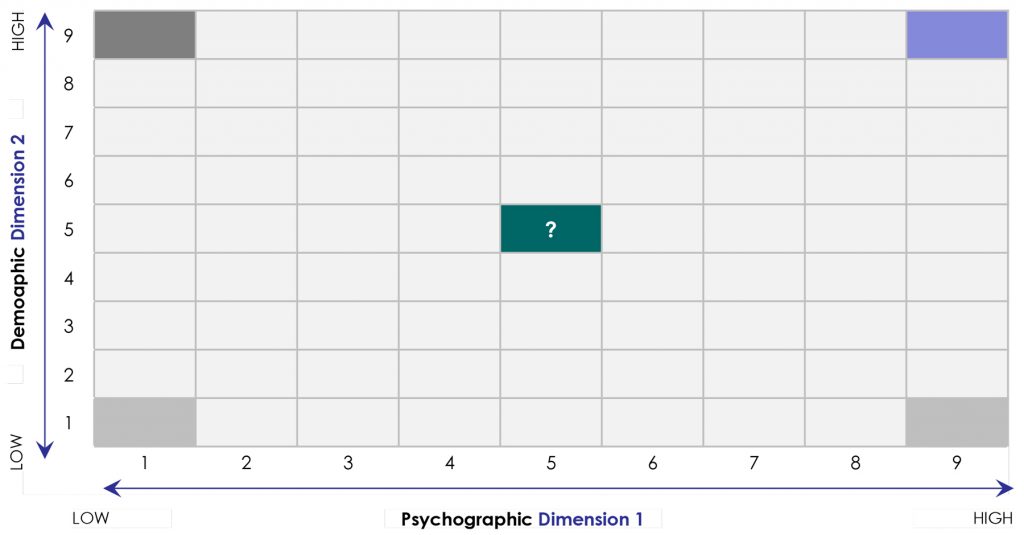

Usually companies use a blend of traditional classification schemes to segment customers, including demographics, psychographics, purchase behavior, and needs-based data. Because these schemes are helpful for sales, marketing, and accounting purposes, when it comes to new-product development companies simply adopt the same customer segmentation schemes out of convenience.

For instance, companies might segment their B2B markets by vertical industry, the size of the company, number of purchases, etc. Similarly, they might segment B2C customers by age, gender, profit bands, etc. The underlying logic is that these classification schemes will identify segments that react uniformly to new products or services. Unfortunately, that logic doesn’t hold.

When applied to new-product development, traditional segmentation leads managers to non-existing segments. These groupings are not homogeneous. They don’t share any similarity about how participants value new products or services. Age, gender, geography, vertical affiliation, etc. are meaningless descriptors. Consequently, traditional segmentation schemes can be misleading when applied to new-product development, as they lend zero predictability of market success of the new product or service.

TRADITIONAL SEGMENTS

OUTCOME BASED SEGMENTATION

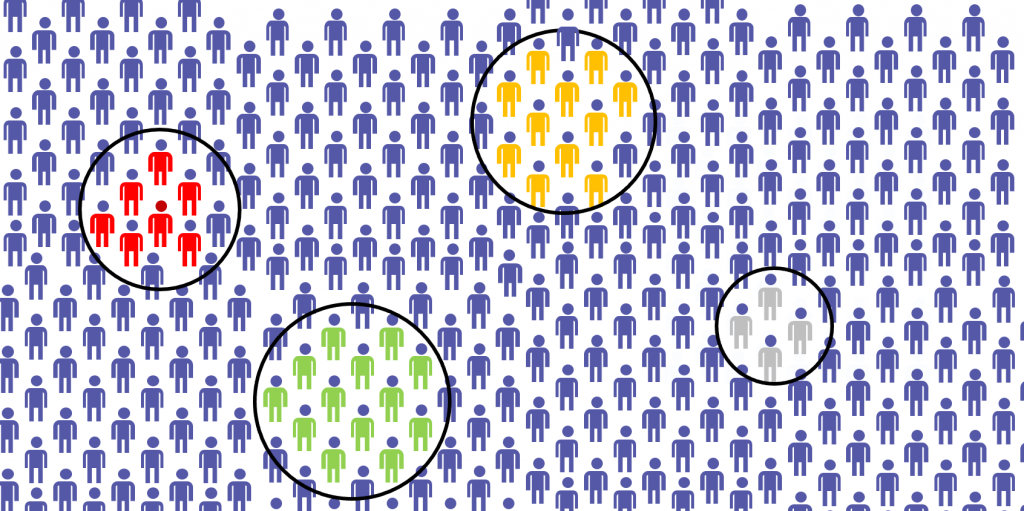

A better approach is outcome-based segmentation. The logic is that customers buy products and services to achieve a desired outcome. For instance, a customer who buys a saw is really interested in the ability to make a cut and not the saw – in which case, making a cut is the desired outcome and the saw is a means to an end. In fact, if customers could make cuts without a saw, they would never consider buying a saw in the first place.

Outcome-based segmentation clusters customers into groups for what truly interests them, i.e. the outcomes they are looking to achieve when purchasing a specific product or service.

CLUSTER BASED SEGMENTS

Back to our example, customers who buy a circular saw may evaluate outcomes for different reasons. Some may be looking for speed because they need to get through a job fast. Others may be looking to make the perfect cut because they are perfectionist in their work. Outcome-based segmentation enables companies to define segments at this level and refine products accordingly. Its applications are extremely valuable.

APPLICATIONS

Source: Anthony W. Ulwick “What Customers Want”

Source: Anthony W. Ulwick “What Customers Want”

Outcome-based segmentation is a highly quantitative exercise. Normally, it analyzes hundred of customers and more than 50 desired outcomes at varying levels of need, and identifies the largest pockets of customers truly underserved.

With it, executive managers can take confidence that new product development is not an isolated affair but can be steeped in market knowledge that is statistically significant about the attractiveness of the new product to customers.

With this information, managers can identify unique opportunities in the marketplace, make effective pricing decisions, determine the best way to enter an existing market, and discover segments of high potential growth.

Citations

- Anthony W. Ulwick “What Customers Want: Using Outcome-Drive Innovation to Create Breakthrough Products and Services,” McGraw-Hill, 2005, New York, NY