Business model design is a fundamental driver of shareholder value creation. It is the foundation for company performance upon which all actions follow. Its primacy cannot be overstated, yet most companies haven’t fully internalized how to compete through business models.

WHY IT MATTERS

A clear indication of the importance of business model design (BMD) is the company’s ability to retain its market position. The lifespan of large, successful companies has never been shorter. Fifty years ago, the average lifespan of a company in the Fortune 500 was 75 years. Today, it is 15 years and declining.1 Businesses get displaced from their market position faster than ever. The pace of change has escalated five-fold, and companies need to stay current and adapt just to keep up. Those that do, reap enormous benefits, those that don’t eventually lose value.

BUSINESS MODEL DESIGN CLARITY

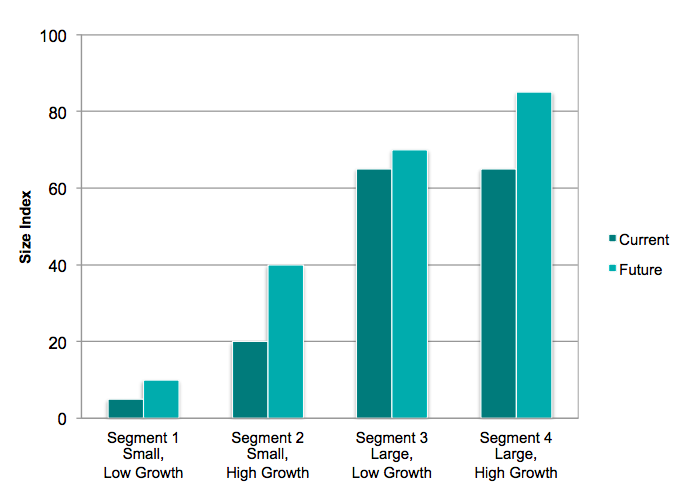

So what is business model design? There are many definitions, but at its core business model design comprises two elements: (1) the company’s value proposition, and (2) its ownership of strategic control points. Effective business model design requires serving attractive market segments with a value proposition that can generate significant value growth, and owning strategic control points to protect profit streams from competitors. The first question is which market segments are you serving now and will you want to serve it in the future?

Exhibit 1. Which Type of Segment Does Your Business Serve: Large, High Growth, Both, Other?

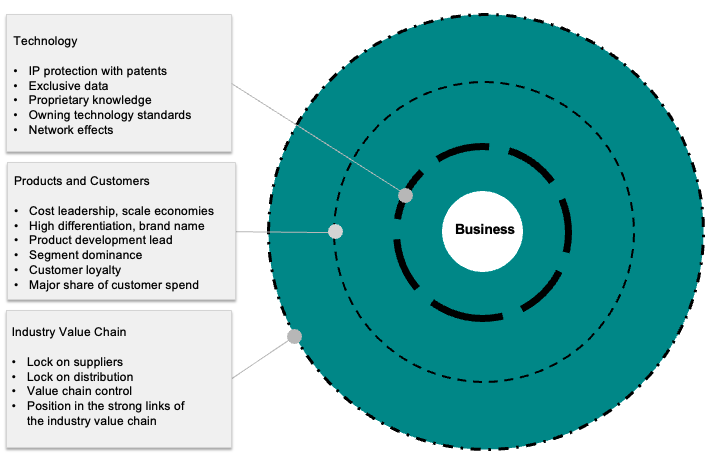

Second, what are strategic control points, and which do you control? Strategic control points (SCPs) are the foundations of defensive business strategy. They are the mechanisms that protect the company’s profit streams against erosion from competitors, customer power, and supplier power. They build the competitive moat around the business and come in many forms. Examples include having a dominant market position in attractive segments, locking up delivery, controlling supplier access, owning a de facto technology standard, and many more. Companies with strong business model designs own at least two relevant SCPs in their industry.

Exhibit 2. Strategic Control Point Examples

In sum, meeting the two conditions of (1) serving attractive market segments with a strong value proposition, and (2) owning at least two relevant SCPs, makes for a solid business model. Conversely, the absence of either condition weakens the model design.

ITS VALUE

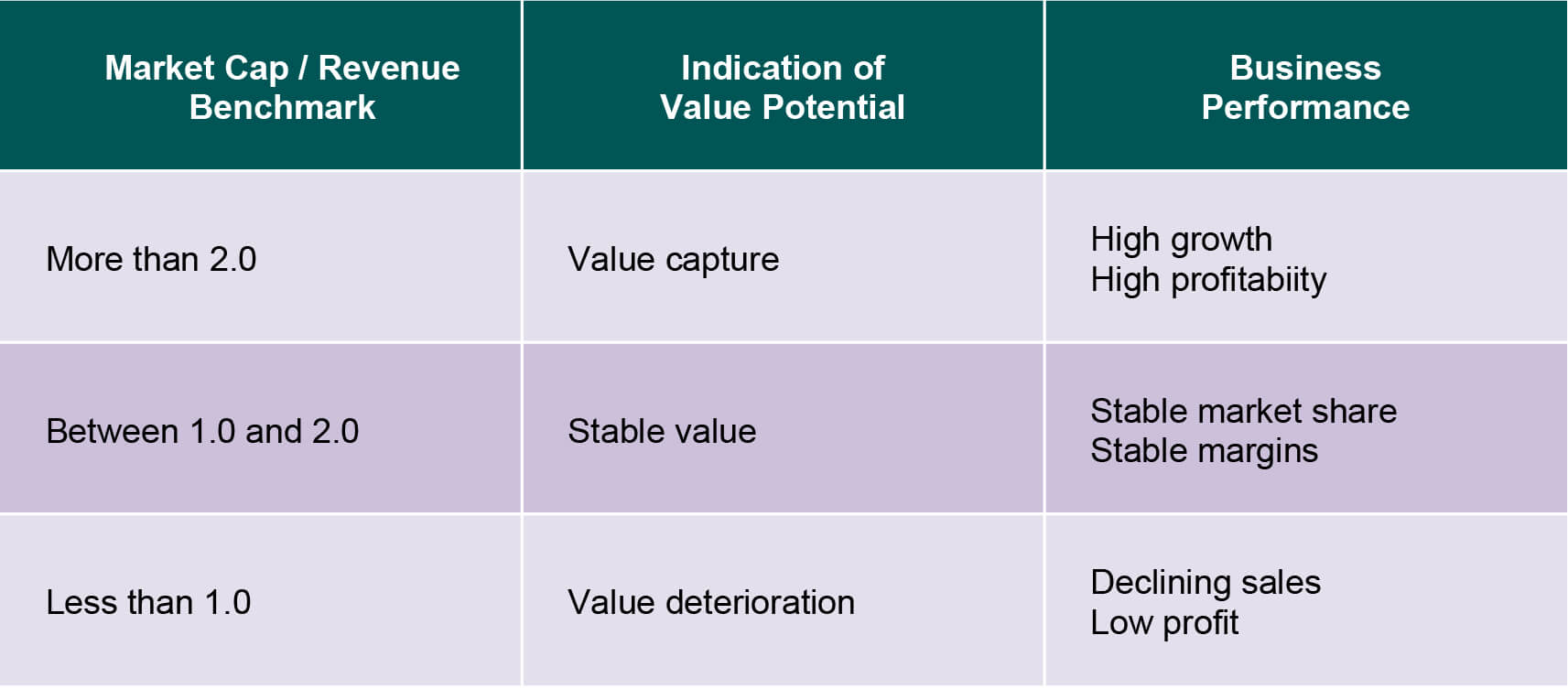

The value of the business model design can be measured by using the ratio of market capitalization to revenue. This index incorporates two important factors. First, it provides a direct measure of the market value of the company, and second it normalizes it for size in terms of revenue.

Also known as the price to sales ratio, this index is particularly valuable because it is easy to calculate and it is used routinely in equity research to predict the value potential of publicly-traded companies. Briefly, the following values of market-value-to-revenue ratio provide an indication of the business model potential to create value.

Exhibit 3. Business Model Design Benchmarks

EXAMPLES

Following are examples that illustrate how companies built their business model design on solid foundations, and went on to generate huge multiples of value.

CASE: Southwest Airlines

Southwest Airlines (SWA) is the biggest low-cost carrier in the world. As a pioneer in the airline industry, it has been operating a unique business model that serves customers looking for quick, low-cost and reliable flights from point to point. Its value proposition is based on the following principles:

- Lowest fare: Thanks to its low-cost structure, SWA is a price leader that offers the lowest fares in the industry.

- Best schedule: Frequent, short-haul flights, quick turnarounds, an affinity for secondary airports and business commuter routes work together to keep flights on time.

- Simple customer service: Southwest offers a single coach cabin and a smaller choice of drinks and food than other airlines offer, which their customers do not value.

Southwest’s business model design is based on several strategic control points:

- Low-cost leadership: Using Boeing 737s only saves the airline significant maintenance costs by carrying an inventory of spare parts, components, and spare engines for just one type of plane. Also, ultra-high plane utilization makes for cost efficiency.

- Best-in-class reliability: The practice of point-to-point flights has enabled Southwest achieve 78% on-time performance, 8 percentage points higher than the industry average.

- Extensive route network: Over time, the airline has been able to add cities and gates to offer flights in more than half of the top 50 U.S. metro areas.

Southwest’s business model design has allowed the airline to become the largest carrier of domestic passengers in the U.S. As of July 2017, It had more than 55,000 employees, operating more than 4,000 departures a day during peak travel season. It is becoming the business model for other airlines to copy.

CASE: Tetra Pak

The company started in 1951 with the original concept of providing hygienic pre-packaging for liquid foodstuff. Today, it offers a range of different packaging and processing products and services in dairy, ice cream, cheese, juice, fruit, and vegetables. Its highly successful business model is designed on solid foundations, including the following:

- Highly differentiated packaging: The company offers packaging that saves more than it costs: (1) it extends the life of the product, keeping food safe, fresh and flavorful for at least six months without refrigeration, and (2) the tetrahedron-shaped package for milk or juice makes it easy to stack and transport.

- Highly quality material: Tetra Pak’s laminated material is light, stable, flexible, durable, and protects against outside moisture, oxygen, and light to maintain the nutritional value and flavors of the food in the package at ambient temperatures.

- Highly differentiated processing equipment: The firm manufactures packaging machinery and equipment for dairy, cheese, ice cream, beverages and prepared food. Its technology includes more than 20 lines including blending, carbonization, centrifugal separators, evaporation, extraction, homogenization, pasteurization, UHT treatment, and more.

Tetra Pak owns several strategic control points in the industry, including the following:

- Supply chain control: With its aseptic carton packaging technology, the company manages the entire cold supply chain from the farm to the store.

- Least cost packaging: Tetra Pak produces the least-cost package in terms of total system’s cost, including production, spoilage, transportation, storage, and disposal.

- Ownership of essential patents: The company owns over 100 patents used throughout its value chain of operations, including food sterilization techniques, laminated materials, processes, packaging technology, machinery, and parts.

- Dominant segment share: The firm has reached a quasi-monopoly market position in the EU, and has 95% of the Chinese market for aseptic carton packaging.

Tetra Pak has become the largest food packaging company in the world with sales of €13.8 billion in 2017, operating in more than 170 countries.

CASE: Qualcomm

In 2004, Qualcomm began to shift its business model from being a pure semiconductor firm to taking control of wireless value chain. The company implemented substantial changes to its value proposition:

- Offering: Moved from provisioning modular, cost-effective chipsets to offering an integrated 3G platform that combined multiple convergent technologies, focusing on 3G CDMA telecom products and services.

- Customers: Widened its customer base from mobile phone manufacturers to include consumer electronics manufacturers.

- Distribution: Evolved from product distribution through telecom OEMs to partnering with third-party developers through an open platform.

Qualcomm managed to secure several strategic control points in the industry:

- Large focused R&D: The firm invested aggressively in R&D, reaching $1.5 billion in 2006. These efforts provided an industry-leading intellectual property portfolio.

- Participation in setting a technological standard: The company introduced “an open applications platform” for CDMA-based wireless devices. The platform enabled software developers to create and monetize feature-rich applications for CDMA devices.

- Essential patents: Through several acquisitions, by 2006 the firm had the most widely licensed intellectual property portfolio in the wireless industry, including 5,100 U.S. patents and 25,800 foreign patents.2

The evolution of the new business model design was gradual and eventually succeeded, resulting in a revenue increase of 250% from 2006 to 2014, with operating margins at 29% in 2014.

COMPETE TO WIN

Business model design is a fundamental building block of competitiveness. Businesses that dominate their market are getting displaced faster than ever. If you haven’t looked at business model design lately, you may want to do so before too long.

New BMD provides a significant opportunity to put your company in a winning position ahead of competitors and industry shifts. Here are a few important questions to guide your discovery:

- What is the market-capitalization-to-revenue ratio of your company?

- How has that ratio progressed over the last few years?

- Are you serving attractive market segments?

- Are customers changing their priorities? How?

- Is technology disrupting or changing conventional value delivery?

- Are new forms of competition emerging in your industry?

- Do you own at least two strategic control points in your industry?

- How relevant are they in the face of new patterns of competition?

Dramatic shifts are happening in most industries. It pays to analyze these shifts from a business model perspective. Firms that change adapt and renew their business model design in light of shifting demand, capture value and sustain success over time. The others, not so much.