A successful company needs to engage in the ecosystem to stay relevant, for several reasons. On the one hand, every company is part of at least one business ecosystem, possibly more, and if it is not actively engaged, chances are its competitors are. On the other hand, growth plans that only address the context of the company’s industry are likely to face severe shortcomings long term. Failure to grasp these realities may cause management to miss opportunities and underestimate threats.

In a world of ecosystems, where industry boundaries soften, the company’s strategy requires a broad, long-term perspective. For a company to engage effectively in an ecosystem, two fundamental choices become immediately relevant in formulating its ecosystem strategy: (1) which ecosystem to participate in, and (2) which role to play.

CHOOSING THE RIGHT ECOSYSTEM

Ecosystems are as diverse as the customer needs and the technologies that drive them. Consider super e-commerce platforms Alibaba and Tencent linking companies in the insurance, finance, healthcare, and real-estate industries. Auto-company networks like the Open Automotive Alliance tying together over 60 OEMs, 30 after-market partners, and more than 50 technology companies. Private systems like Kaiser Permanente’s “My Health Manager” connecting 9 million members, including patients, care providers, pharmacies, physicians, and care centers; social platforms like WeChat, Facebook, and Twitter, networking millions of users; mobile payment platforms, including Alipay and WeChatPay connecting customers to millions of merchants worldwide, and the list goes on. There are thousands of ecosystems, incredibly diverse, and choosing the right one can be overwhelming.

So, what is the right choice of an ecosystem for your company? We suggest following a three-step approach to help cut to the chase quickly:

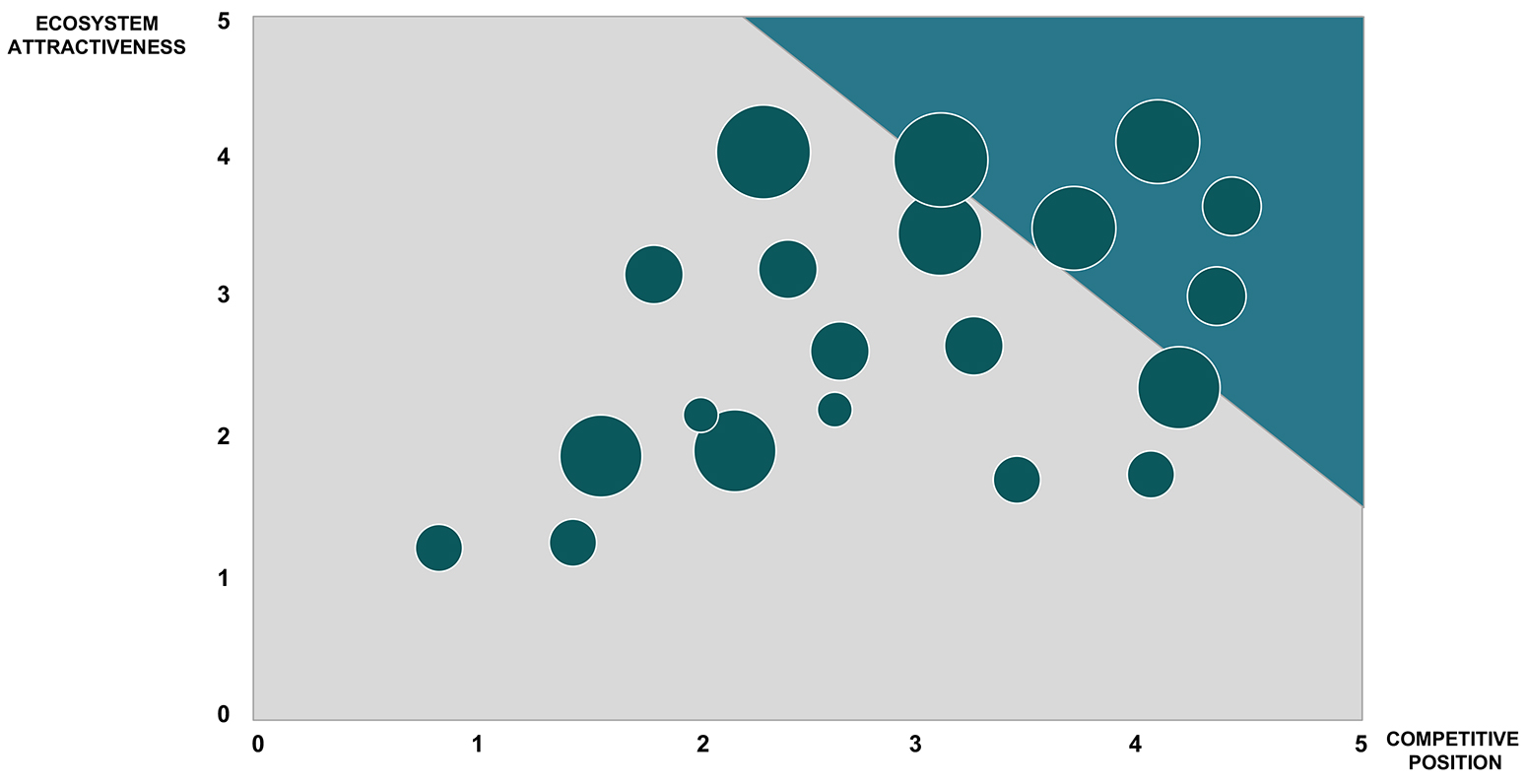

- Evaluate the attractiveness of the ecosystems where your company wants to operate, including market size, growth potential, profitability, and level of competitiveness, and

- Assess your company’s competitive capability, and take into consideration your customer base, access to data, relevance to your core business, and potential alliances and networks to exploit.

- Use these measures together to guide you quickly and confidently and focus on attractive ecosystems where your company has a strong competitive position (Exhibit 1).

Exhibit 1. Choosing an Ecosystem Where to Play

SELECTING YOUR ROLE

After choosing the right ecosystem, corporate leaders need to decide what role the company will play in it. Five distinct models emerge across the spectrum of most ecosystems (Exhibit 2). While each can be an excellent vehicle to create new value, the most significant opportunities lie with owning the strategic control points that can sustain advantage.

Exhibit 2: Selecting Your Role

- Participant

- Participant

-

- Function: Links to the industry value chain (digitally or otherwise) through applications, data, and new digital devices

- Number of Partners: 1, the network

- Role of the Company: Provides valuable information (rich, real-time, ubiquitous) on products and services, updates, and new offerings

- Revenue Engine: Generates sales revenues by increasing its differentiation and market visibility

- KSFs: Maintain speed of information and a high level of product differentiation

- Example: Any connected device (industrial or consumer)

- Niche Network

- Niche Network

-

- Function: Operates a closed architecture to collaborate with partners

- Number of Partners: 20 to 50

- Role of the Company: Organizes partners and works closely with them to provide digitized solutions

- Revenue Engine: Delivers desired value-added products (e.g., smart-home energy solutions) that command a premium, generate additional income from integrated services, and improve customer loyalty.

- KSFs: Select partners with the desired IP and functionality

- Example: Cat® Connect

- Data Aggregator

- Data Aggregator

-

- Function: Provides an open architecture for participants to access data to address industry-wide problems.

- Number of Contributors: > 1,000

- Role of the Company: Captures data and gives participants the ability to share extended, privileged data sets, and the capabilities to develop these sets into new data-driven products and services.

- Revenue Engine: Generates revenue by monetizing data sets

- KSFs: Scale up rapidly and take advantage of the data “virtuous cycle” effect

- Example: INspire™

- Platform Owner

- Platform Owner

-

- Function: Provides a technology platform to create supply and demand, organizing business partners and providing comprehensive experiences for customers.

- Number of Contributors: > 1 million

- Role of the Company: Creates the standards-based technical foundation (e.g., operating systems, devices, software, and applications) that enables parts of the ecosystem to connect and work together.

- Revenue Engine: Generates revenues by charging for the use of the platform

- KSFs: Scale up quickly and maintain a massive number of partners

- Example: Amazon, Apple, Google

- Super Platform Integrator

- Super Platform Integrator

-

- Function: Integrates several platforms into diverse sets of service offering.

- Number of Contributors: > 100 million

- Role of the Company: Generates large data sets across multiple industries and platforms. Organizes and negotiates data sharing across platforms.

- Revenue Engine: Monetizes data sets across platforms and added services through ads and e-commerce.

- KSFs: Use established interfaces across platforms

- Example: Alibaba, Tencent, WeChat

The choice of role becomes increasingly evident in addressing the following set of questions:

- What is the company’s competitive position?

- What are its strategic objectives?

- What is the level of relatedness to the business?

- What are the internal capabilities and constraints of the firm?

- What is its ability to deal with uncertainty?

Based on this information, management can decide which of these roles make strategic sense for the company. With this selection in place, the next step involves determining which initiatives to pursue.

CONCLUDING REMARKS

It’s hard to get growth right in the ecosystem. Meeting this challenge comprises ambitious initiatives that often don’t come to fruition, partly due to the high level of uncertainty involved, but also because ecosystem initiatives often get managed like conventional ones: short time horizon, two-year payback expectations, the least allocation of resources justified by the risky nature of the initiative, and lack of staying power during economic downturns.

Corporate leaders need to manage ecosystem growth like venture capitalists to be successful: long time horizon, comfortable with uncertainty, in-depth industry knowledge, full organizational support, the allocation of the right amount of resources toward capability building, and rigorous due diligence.