We follow the performance of the U.S. economy and publish a quarterly overview of the economy with a dashboard of indicators and implications for business.

THE U.S. ECONOMY: A DASHBOARD

On display, a dashboard of select economic indicators appropriate for business managers helps to take a meaningful snapshot of the economy. Any single indicator taken in isolation provides little value. Together at the dashboard level, the indicators and supporting charts offer a current high-level view and an easy comparison to draw your conclusions about the economic outlook, changes in the economic cycle, or other critical economic shifts.

EXHIBIT 1. A DASHBOARD OF THE U.S. ECONOMY

Lagging Indicators

Change

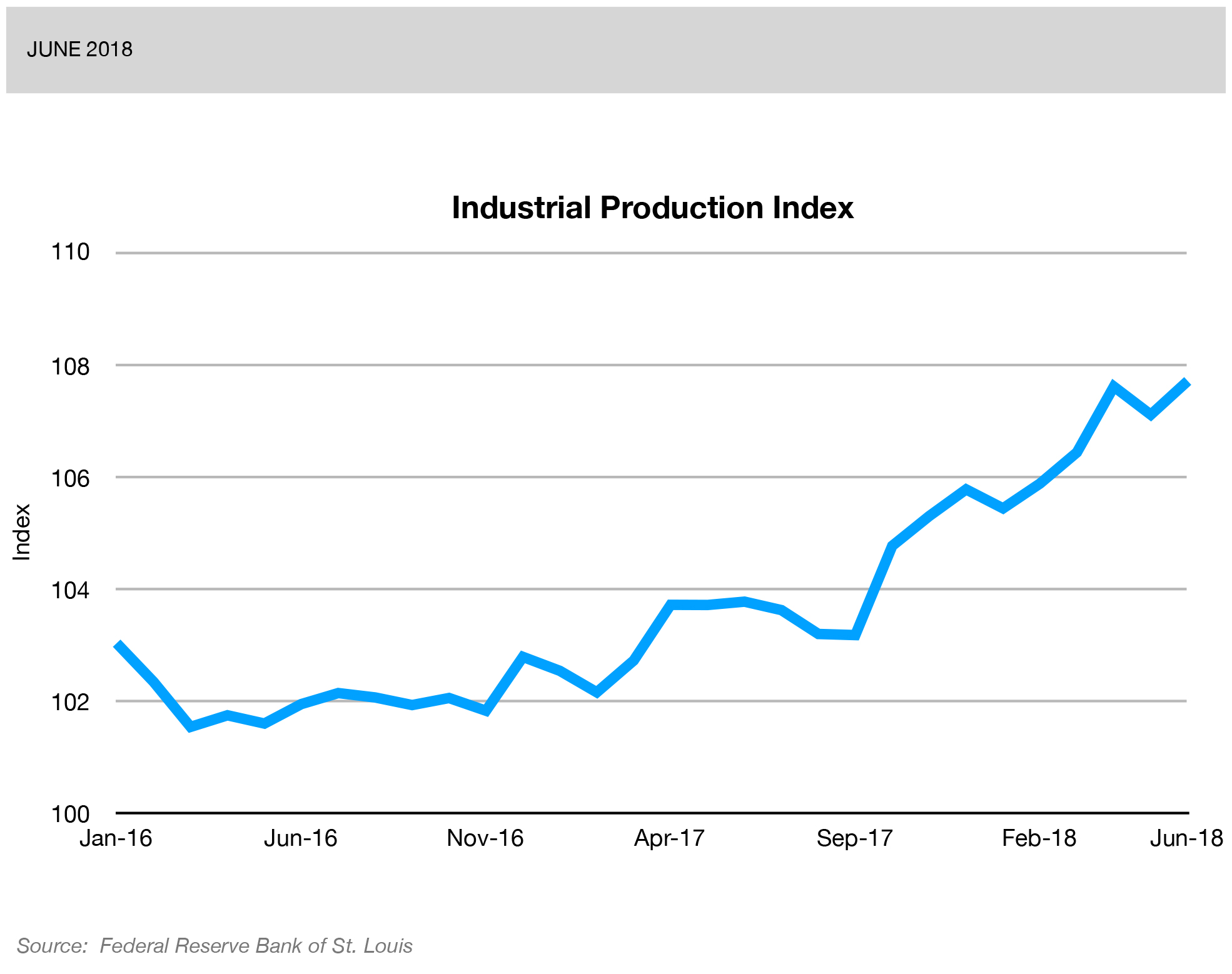

This index measures the amount of output from the manufacturing, mining, electric, and gas industries. The reference year for the index is 2002 and a level of 100. A measure growing month-over-month is a sign that the companies in the industry are performing well.

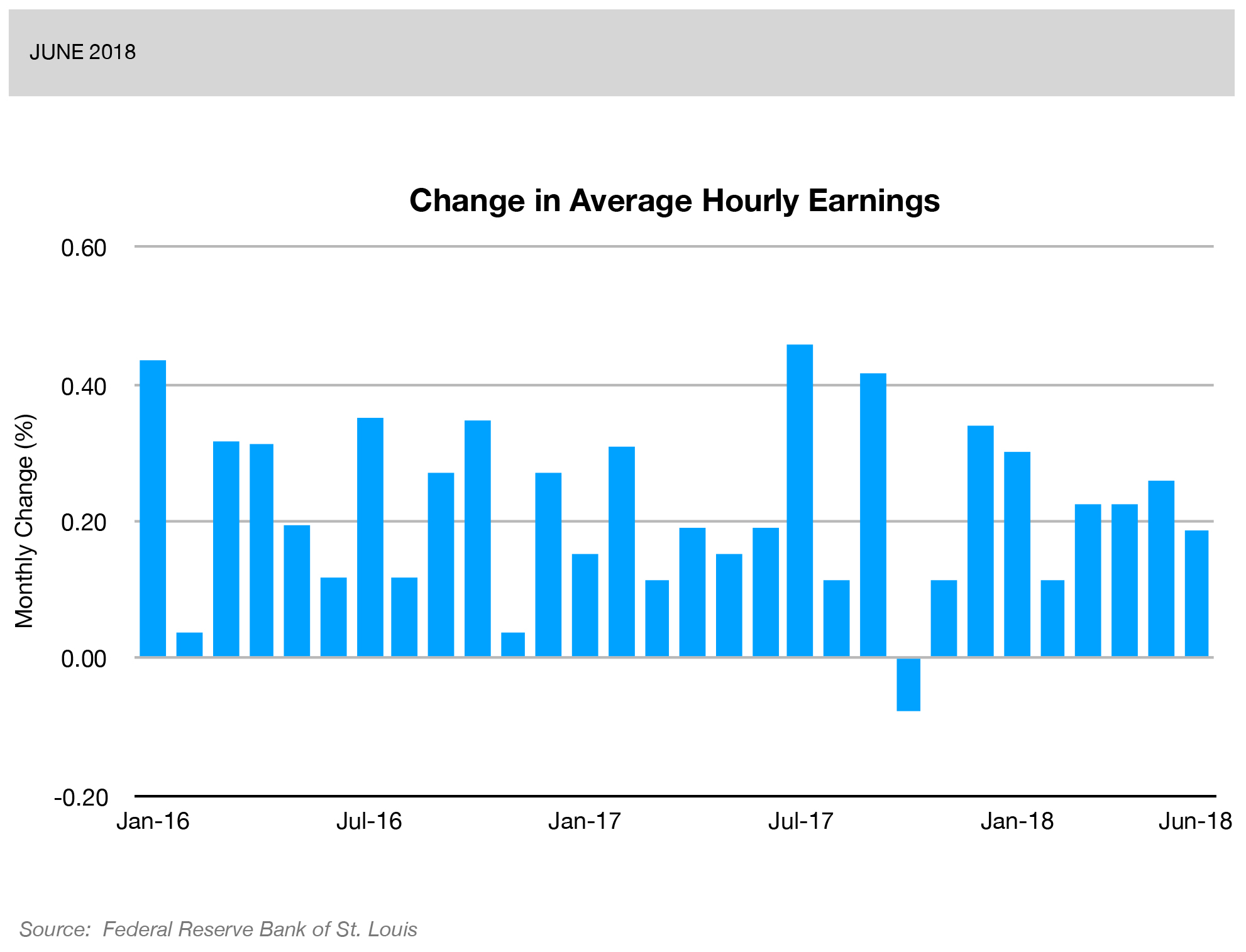

Source: InvestopediaThis is an indicator of buying power and consumption. A positive change means workers are getting paid more. If not eroded by inflation, an increase in earnings means more money to spend. Conversely, a negative change means workers are getting paid less, reducing buying power and consumption.

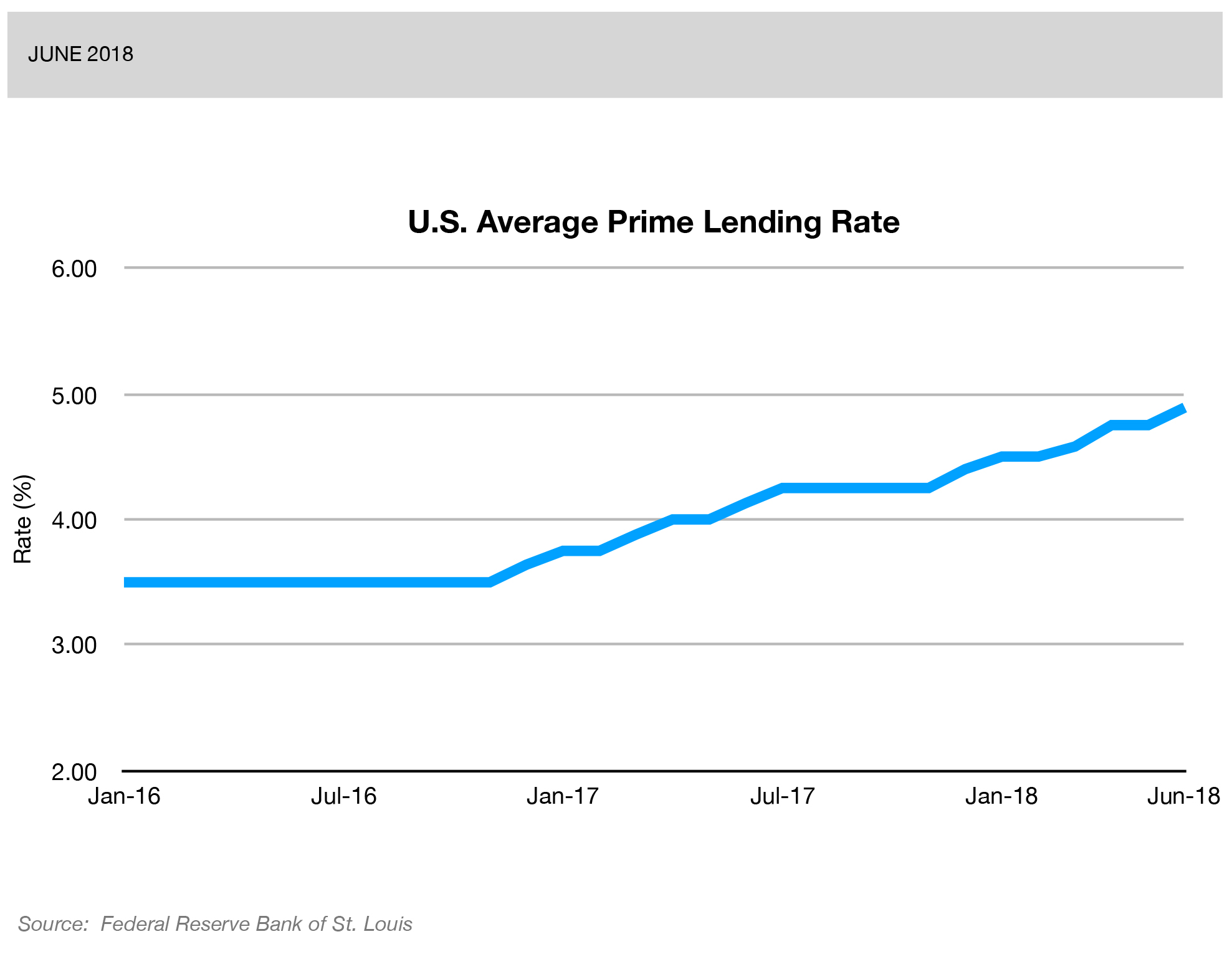

This measure is the average rate of interest charged on short-term loans by commercial banks to companies. High interest rates discourage businesses to borrow and invest. As a result, GDP growth slows down. Low rates can lead to an increased demand for money and raise the likelihood of inflation.

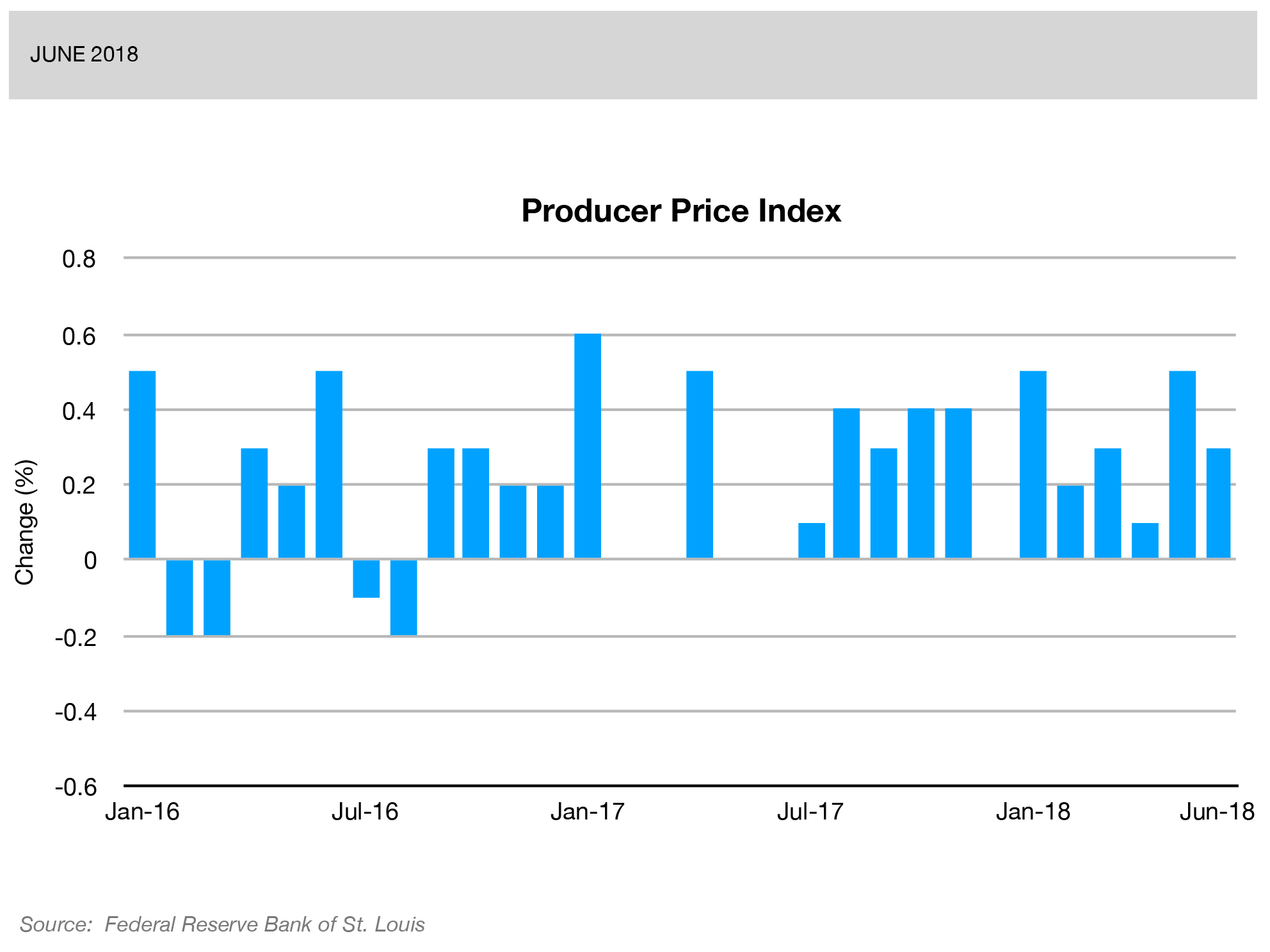

Source: WT Wealth ManagementThis index measures the average change over time in the selling prices received by domestic producers for their output, including finished goods, intermediate goods and crude goods. The index is timely because it is the first inflation measure available in the month.

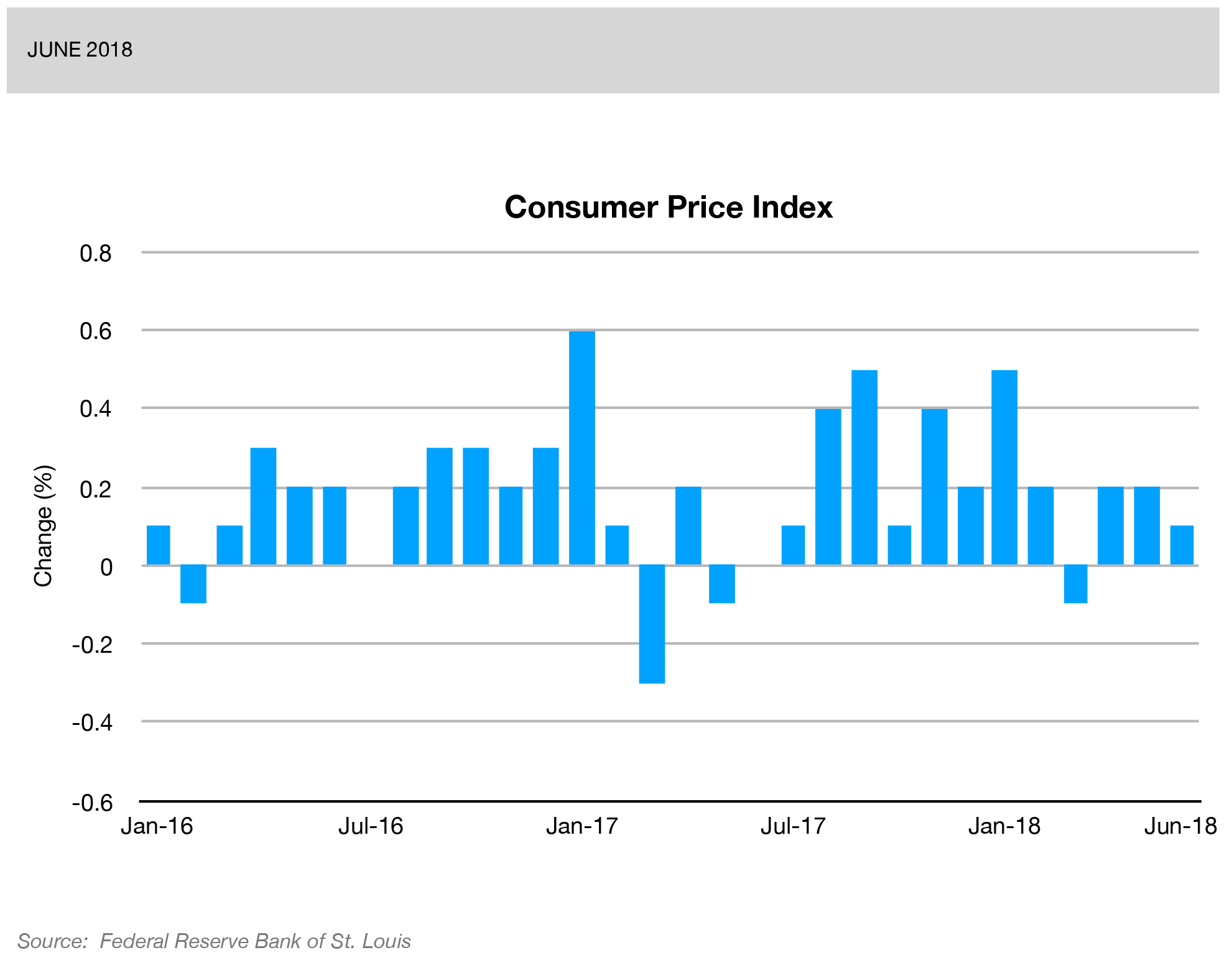

This index reflects monthly data on changes in the cost of living, or inflation. A high rate of inflation may erode the value of the dollar more quickly than the average consumer’s income can compensate, thus decrease consumer purchasing power. The index is the best indicator of inflation.

Lagging indicators depict current economic conditions and confirm turning points in the economy.

Leading Indicators

Change

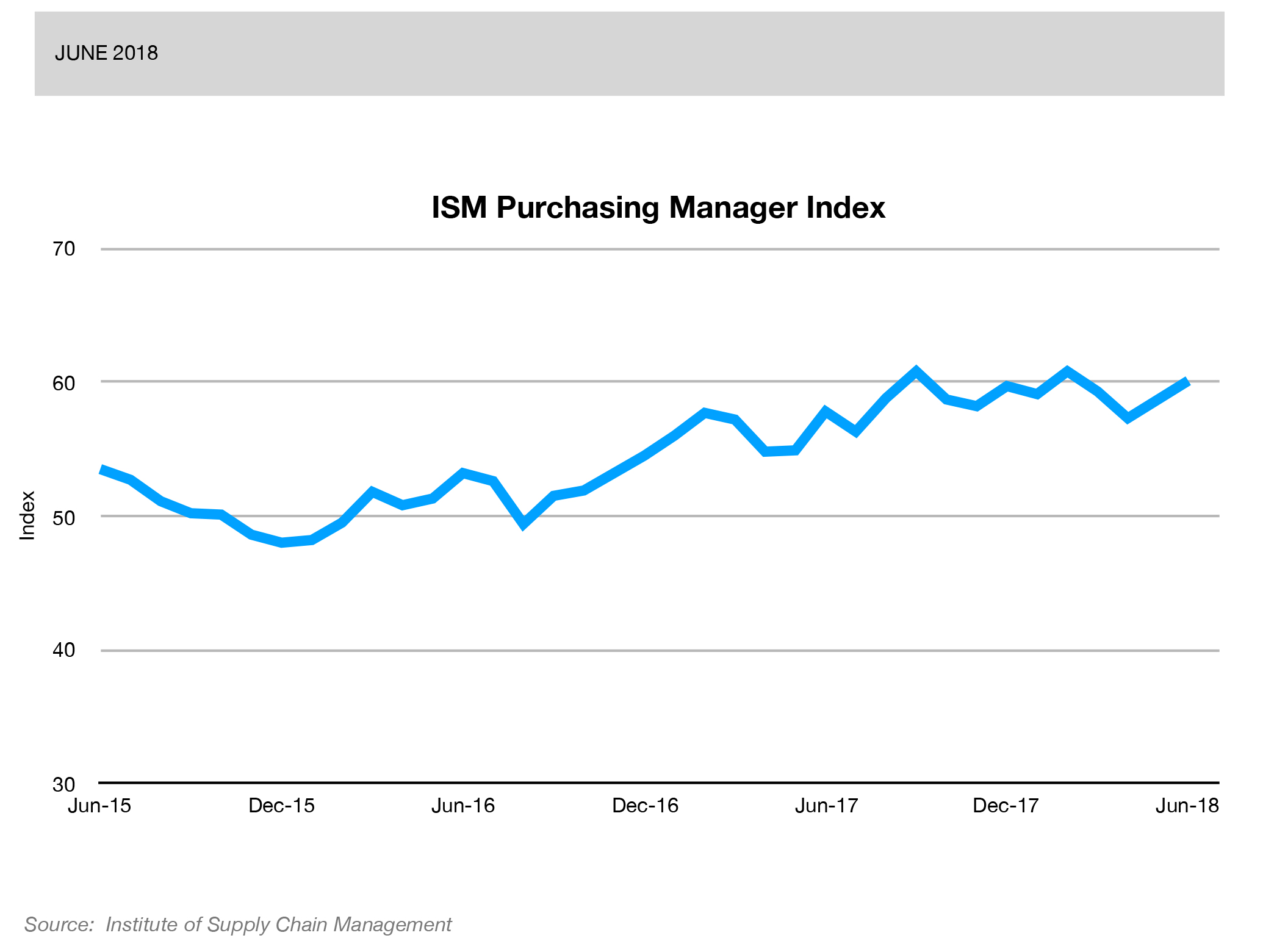

Historically, readings of 50 percent or above are associated with an expanding manufacturing sector and healthy GDP growth overall. Readings below 50 indicate a contracting manufacturing sector but overall GDP growth is still positive until the ISM index falls below 42.5 (based on statistics through January 2011).

Source: Bloomberg News

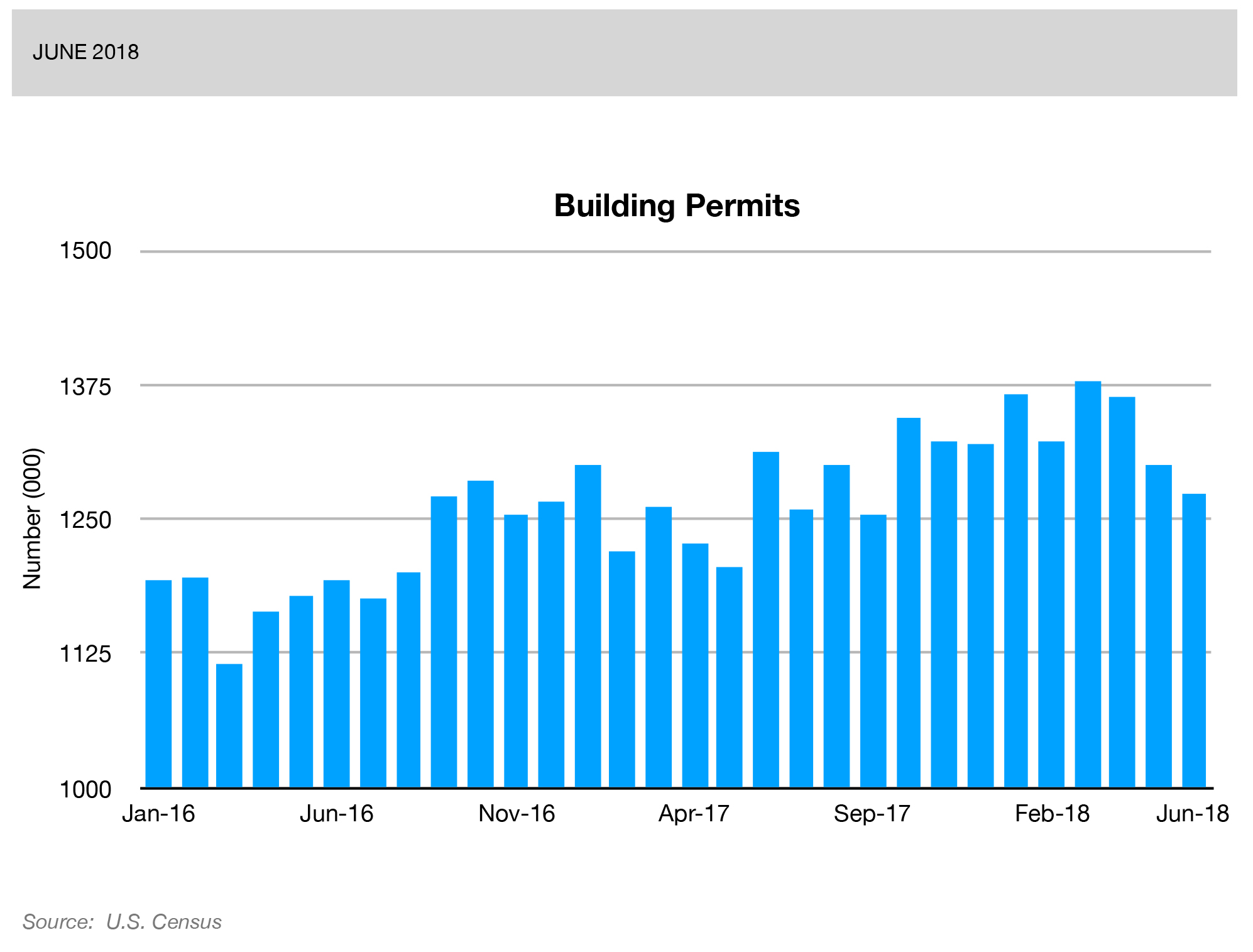

The housing construction market is one of the first economic sectors to rise or fall when economic conditions improve or degrade, and building permits can be an early indicator of activity in the housing construction market.

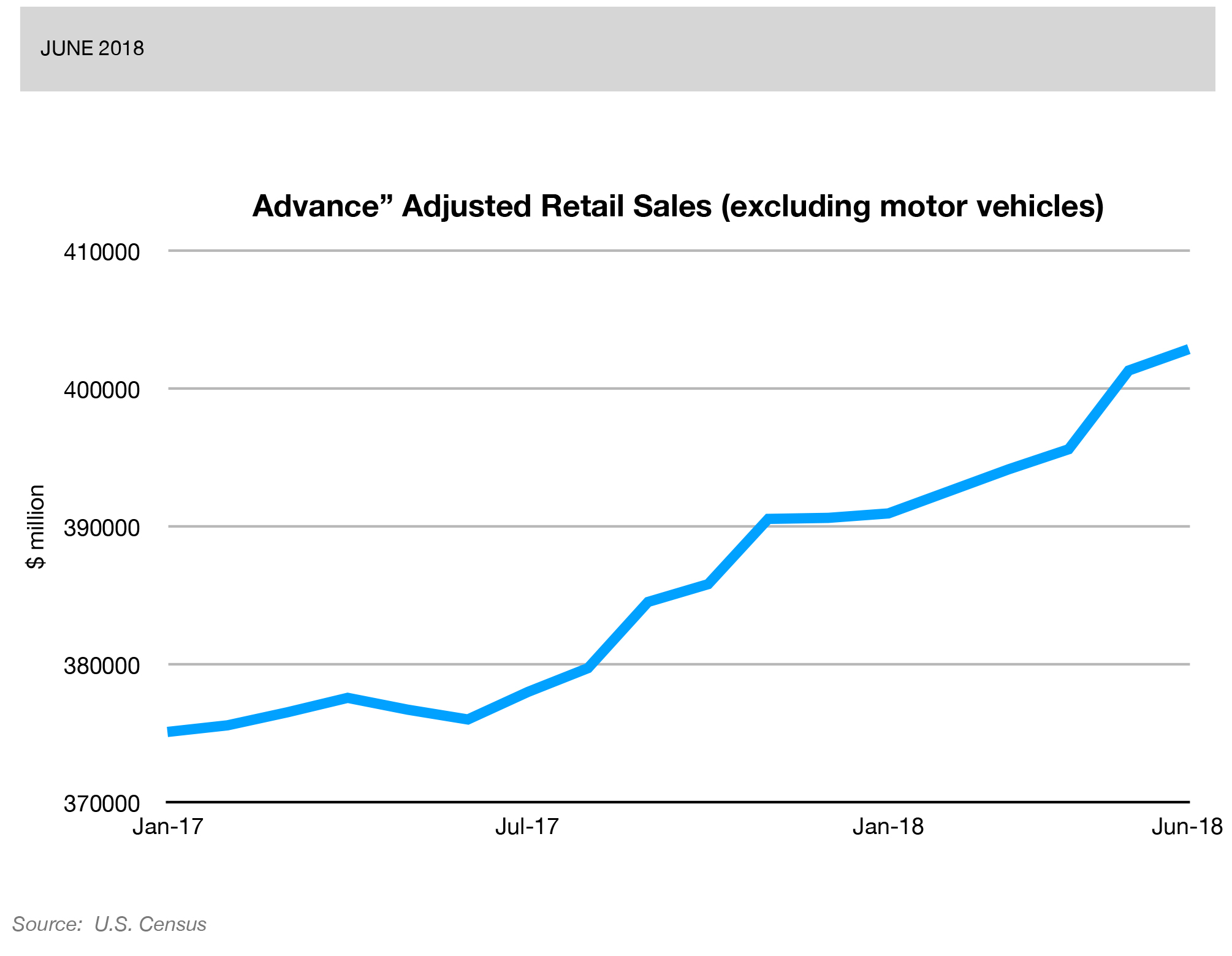

Strong retail sales directly increase GDP. When sales improve, companies can hire more employees to sell and manufacture more product, which in turn puts more money back in the pockets of consumers. Weak retail sales have the opposite effect.

Source: WT Wealth Management

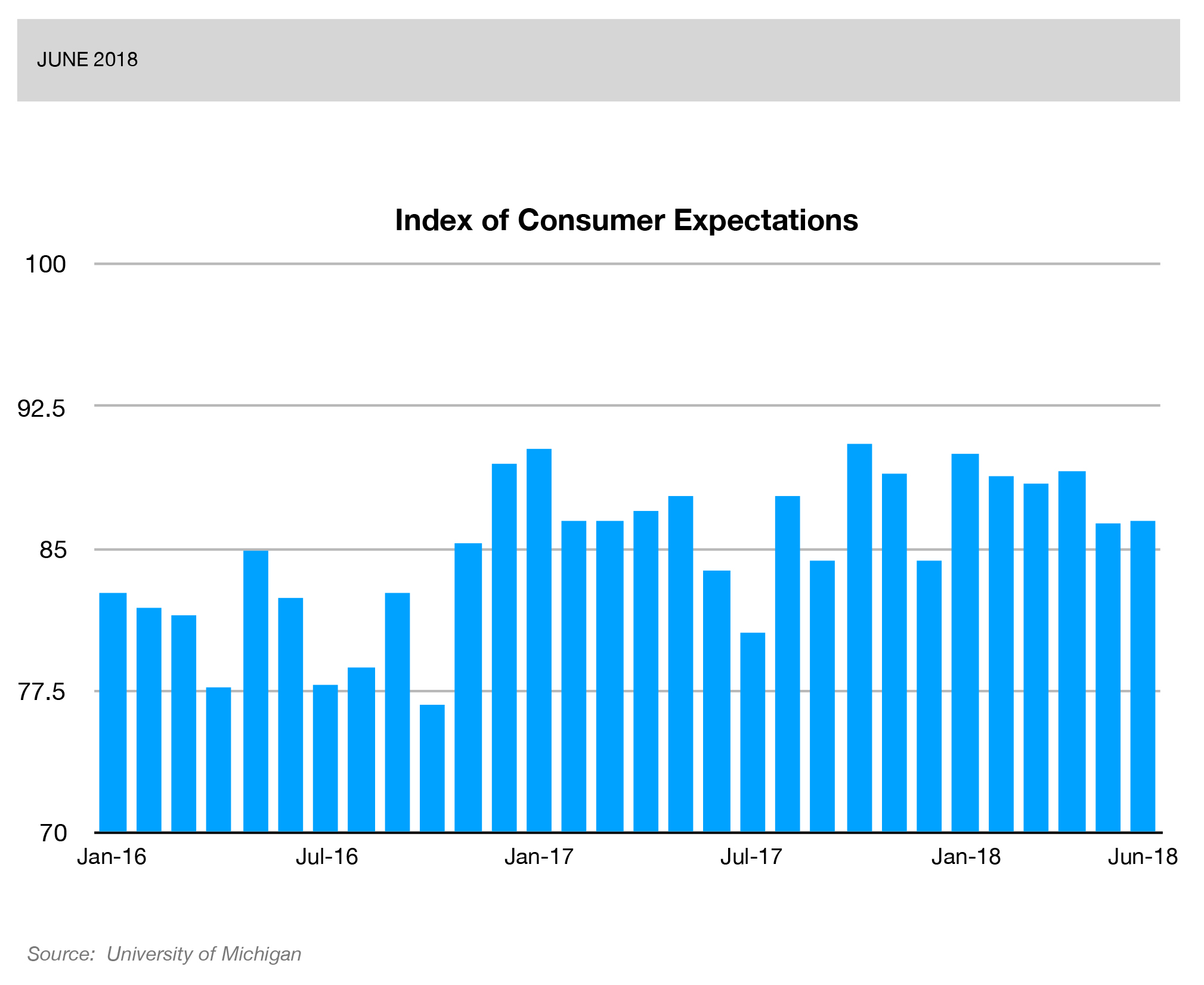

The index measures overall consumer sentiments about business toward the short-term (12-month) future economic situation.

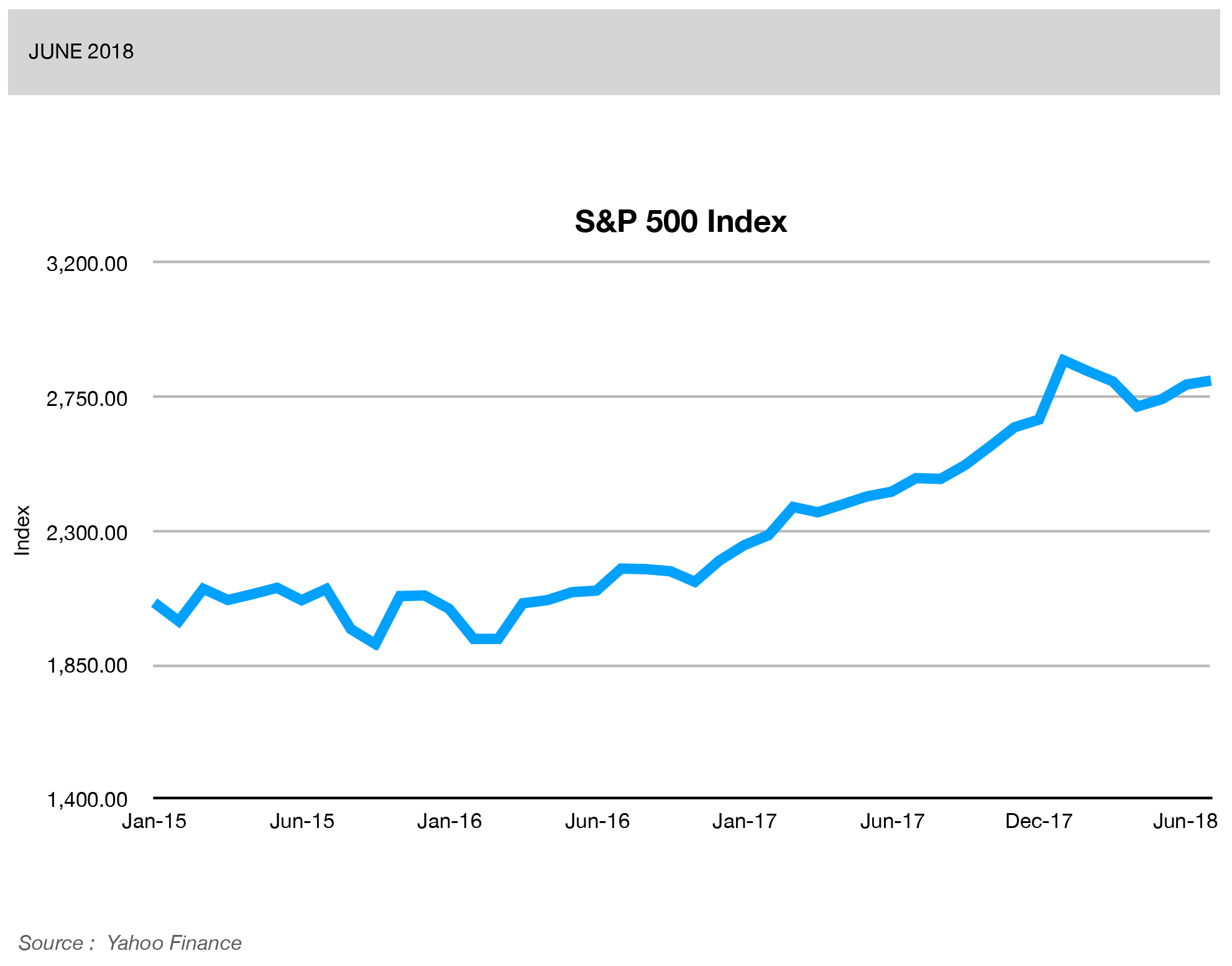

The index is used as a gauge of future business and consumer confidence levels. Growth of the S&P 500 index can translate into growth of business investment. It can also be a clue to higher future consumer spending. A declining index can signal a tightening of belts for both businesses and consumers.

Source: American Association of Individual Investors

Leading indicators are first to change direction ahead of a business cycle and signal change before actual changes occur in the economy.

On display, a dashboard of select economic indicators appropriate for business managers helps to take a meaningful snapshot of the economy. Any single indicator taken in isolation provides little value. Together at the dashboard level, the indicators and their supporting charts offer a current high-level view and an easy comparison to draw your conclusions about the economic outlook, changes in the economic cycle, or other critical economic shifts.

Economic activity continued to expand across the United States during Q2, 2018 with GDP growth at 4.1%1, and with lagging indicators showing healthy economic performance. However, there may be more than meets the eye as we look ahead.

Two leading indicators, i.e., Consumer Expectations and Building Permits, are showing signs of softening. If the economy is strong, why would that be the case? There is truth in numbers.

Also, the Fed’s July 2018 Beige Book indicated that “Manufacturers in all Districts expressed concern about tariffs and in many Districts reported higher prices and supply disruptions that they attributed to the new trade policies.”2

How will the current economic outlook

impact your business?

ECONOMIC ISSUES AND EXECUTIVE CONCERNS

Economic indicators tell only part of the story. A round-up of recent business surveys3 reveals the economic issues that executives worry about the most:

- Uncertain economic conditions and future economic policies.

- Increased uncertainty surrounding the direction of U.S. trade policy.

- Increased costs from tariffs, including costs of imports for consumers, and costs of inputs for businesses

- Significant restrictions on US imports, disrupting supply chains

- Businesses holding back on investments to restructure their supply chains due to uncertainty about future policy.

- In the short run, uncertainty about border-crossing costs reducing investment spending.

- Management’s reluctance to put capital in place when facing the possibility of a sudden shift in costs.

There appears to be some convergence between the big picture of the economy showing softening select leading indicators and the business uncertainty and rising input costs that executives see happening on the ground.

Are executive concerns about the economy

valid for your business?

BUSINESS IMPLICATIONS

Together, softening leading indicators and executive surveys show concern that economic tailwinds are shifting to headwinds. If something doesn’t change soon, the economy will suffer damage in the following months.

Many executives are taking a wait-and-see attitude to get more clarity on the situation and are scaling back investments in the meantime. Others are taking short-term actions.

Anecdotal evidence suggests that manufacturers have been racing to shore up supplies of steel and aluminum to head off price increases in anticipation of future tariffs.4

Similarly, farmers have taken proactive measures by front-loading exports of agricultural goods ahead of tariffs. What is less clear to them is how to plan inventory of seed today for next year’s crops given the volatility of their export markets.

Eventually, a more strategic course of action becomes essential in putting the company in a strong position ahead of an economic slowdown. Companies can begin assessing their exposure to shifting economic winds and the impact on their competitive position. Four straightforward questions can provide insight into how to navigate the changes taking place.

- What is your competitive position?

| Strong | Defend Secure two or more strategic control points |

Grow Pursue growth initiatives leveraging strategic control points |

| Weak | Recover Redesign the business model - or exit |

Streamline Reduce costs and manage cash flow efficiently |

| Weak | Strong | |

- Does the current economic climate enhance your competitive position and is it conducive for your business to succeed? Does it advance your strategy? Strengthen your financial position? Add impetus to grow the business?

- Alternatively, does the current economic climate weaken your position and set your business further back? Does it cause your company greater urgency to cut costs? Drive a more pressing need to defend your market position? Require drastic measures to survive?

- If so, what strategic action are you taking?

Unstable situations create business shock waves. Leveraging this knowledge sets winning companies apart from the pack and ahead of trends. It behooves business leaders to think several moves ahead and be prepared to deal with economic uncertainty, rising costs, and slower asset turns in the upcoming business environment.

What view do you see from your perspective?

How do you adapt to the current economic environment?

Let us know or comment below.